Market Snapshot: March 2025

In Summary

The world is changing

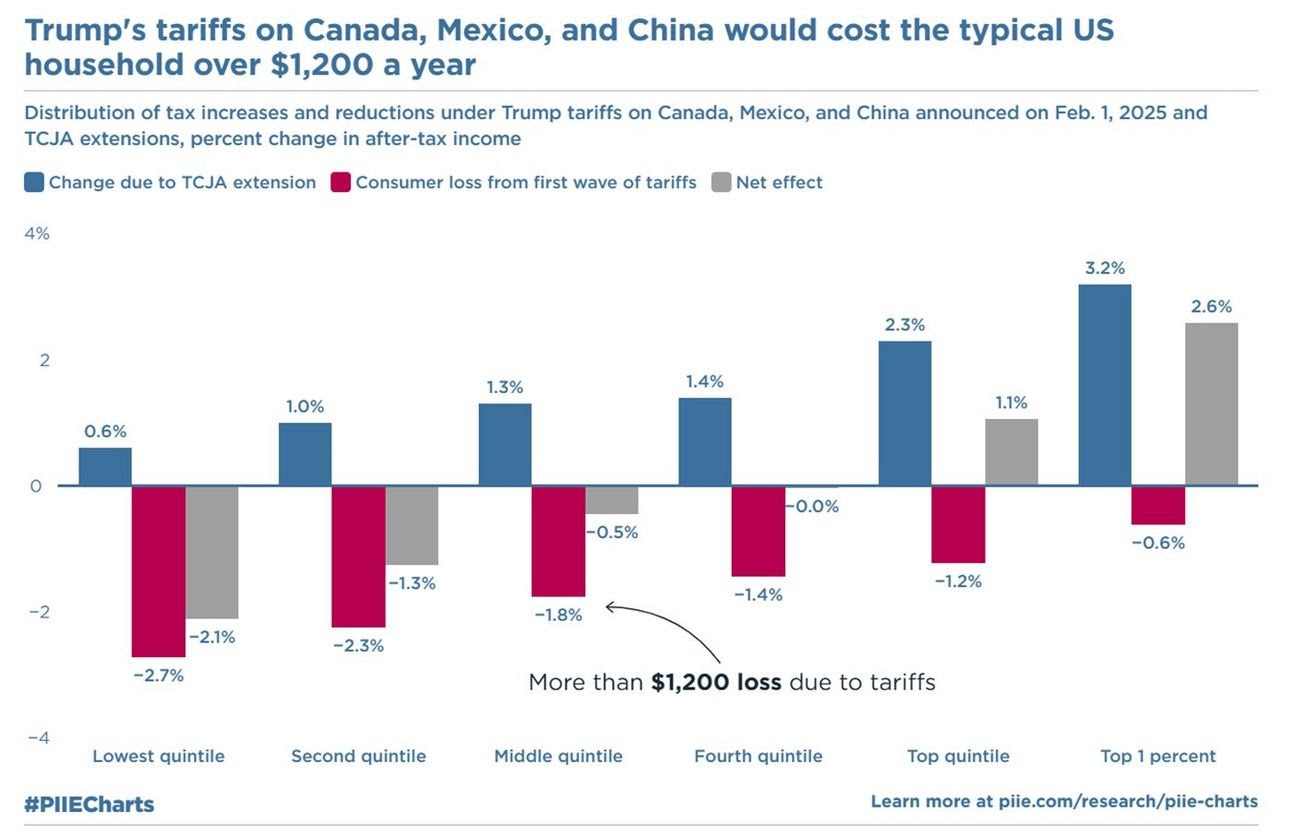

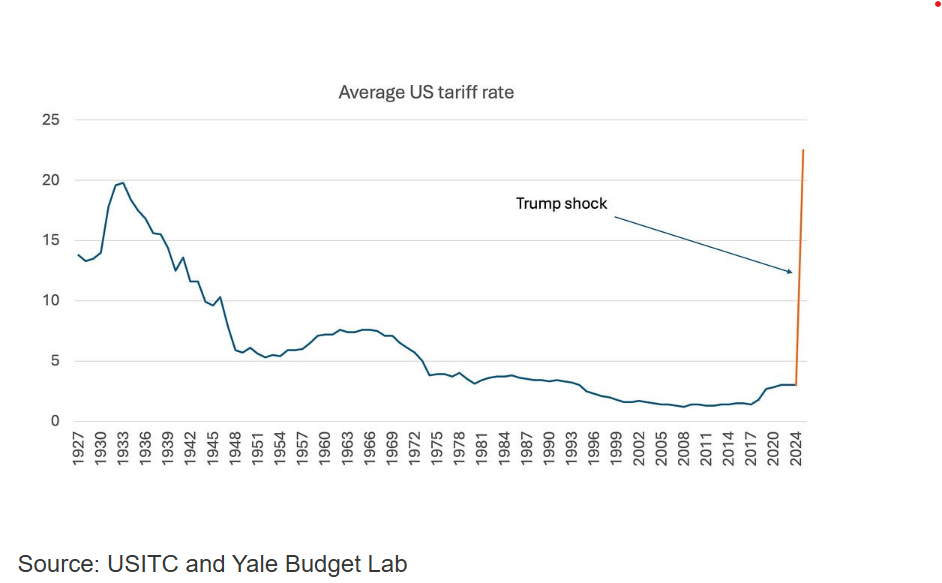

- The Trump Tariffs are imposed on the world, (or are they?) China and other countries have retaliated and sharemarkets declined as the economic growth expectations also decline.

- Cash and Bonds were the safe haven with positive returns. Bonds have proven again they can be a good diversifier with a weakening economic outlook, although volatility is likely due to a likely short term inflation problem coinciding with weakening economic growth.

- The tariffs have also provided a change in the outlook for cash rates. Current markets suggest Australian cash rates may be down to around 2.9% by the end of 2025.

- Whilst sharemarket volatility is likely to continue in the short term we don’t know how this lands and it is essential sharemarket investors do not panic sell as we do not know if most of the decline is complete, and we do not know when markets will turn around.

- Our core investment message today is to maintain diversification with focus on the long term and not the current volatility (acknowledging its always easier said than done). Major risks currently lie with expensive sharemarkets, including large companies of the USA, and we continue to favour quality (i.e. good profitability) and value (i.e. “cheap”) styles for long term investments in shares. Quality bonds continue to show good value, and this volatile period is only starting to show new investment opportunities.

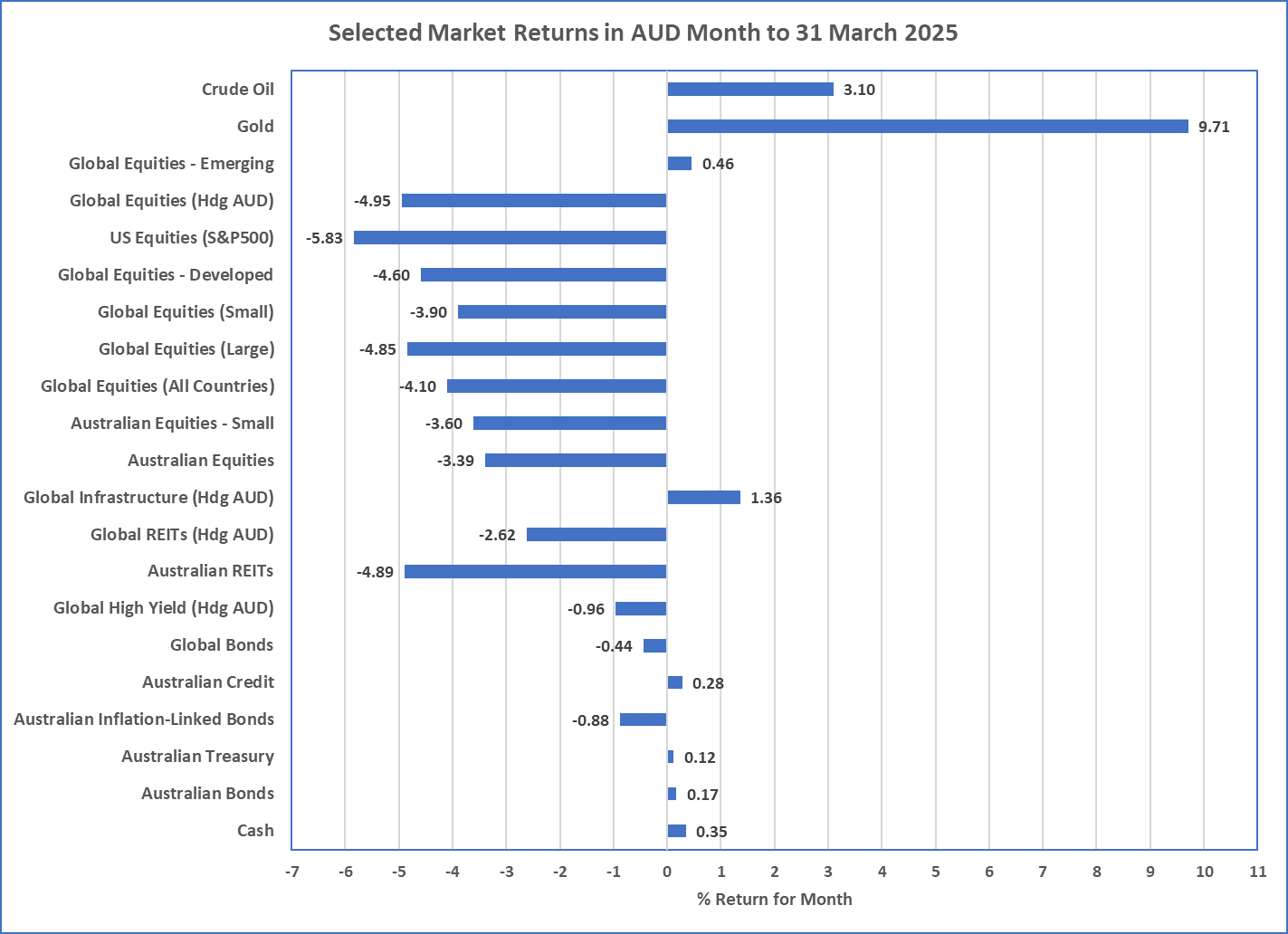

Chart 1: Tariffs hit USA shares the most in March … and they’ve barely started (we know they start in April)

Source: Morningstar

What happened last month?

Markets & Economy

-

It seems fairly redundant to mention economic data as Unemployment, Inflation, Economic growth data is based on either to the end of the

2024 or to the end of January or February and they don’t reflect anything to do with what is unfolding due to Trump Tariffs.

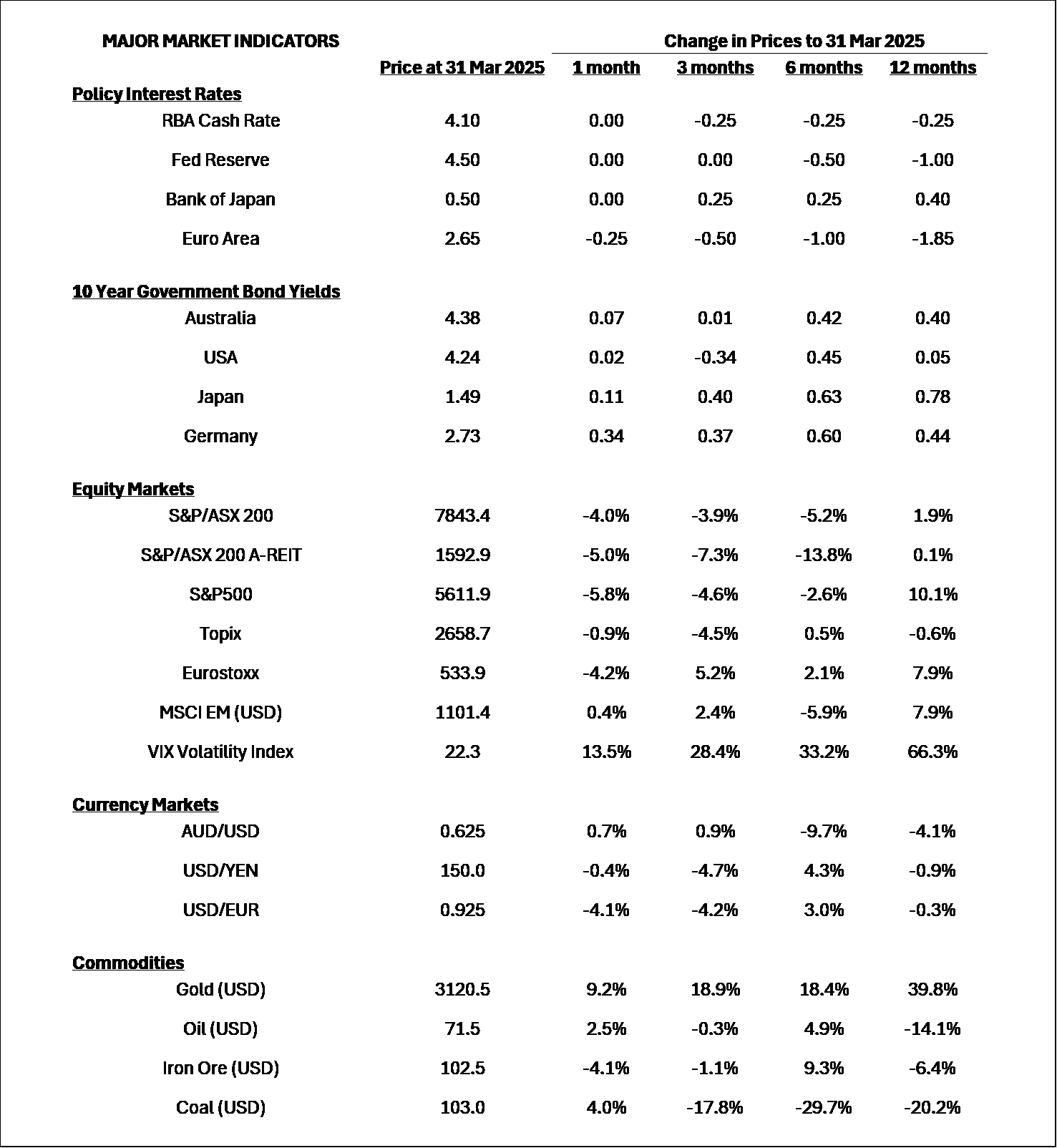

- Unemployment is currently low, economic growth is positive (except Germany and France), and inflation is generally within desirable bounds around the world.

-

The start of the Trump tariffs created seriously negative sentiment amongst the sharemarkets of the world and particularly the USA where

sharemarket returns were weaker than many of Trump’s intended targets. In fact Emerging Markets, which has around 30% in Chinese shares,

were positive in March whilst the USA was down around 6%. The fear index, VIX, increased around 14% to 22.3 which is above long term

averages (generally around 20).

- At the risk of being too out of date, we know "Liberation Day", which is the broader application of Trump Tariffs to the rest of the world, have created a sharemarket crash (rivalling any of the worst markets since the GFC) to all sharemarkets around the world.

- Conservative, boring, cash and bonds were best performing asset classes and the previously struggling Global Infrastructure asset class, often seen as a defensive sharemarket position, also produced positive returns in March.

Outlook

- The Trump tariffs imposed at the start of April have resulted in widespread downgrades to economic growth around the world as Tariffs reduce spending power for all. Interestingly, it is the USA who will most likely experience the strongest reduction in growth and some economists have downgraded US 2025 economic growth to a negative number (which is recession).

- Sharemarkets are volatile and expected to be volatile for some time whether tariffs are in place or not as the issue is economic uncertainty. Tariff levels imposed by the USA (2 April) are the highest they have been ever and this increase from fairly low levels has never been done before. Therefore the actual estimated impacts are ultimately unknown so it is somewhat natural for higher volatility to accompany high uncertainty.

- At the time of writing many markets are cheaper, but the USA sharemarket remains expensive. High yield investments were expensive not that long ago and are starting to show good return expectations and opportunities are likely to rise if volatility continues. Higher quality bonds generally have appealing interest rates but are also volatile and have been declining in anticipation of economic slowdown.

- In Australia, rate reduction expectations have increased significantly. Markets are currently pricing in rate cuts that would leave the RBA Cash rate around 2.9%.

- All of that said, current 5-year return expectations of a typical balanced multi-asset investment with around 60% in growth assets have barely shifted and continue to be around 6-7%pa over the next 5-10 years.

- Overall, the general portfolio position is unchanged and centres on diversification. Volatile markets are likely to continue over the next few weeks or months and diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions.