Market Snapshot: June 2024

In summary

A quiet month where not too much has changed

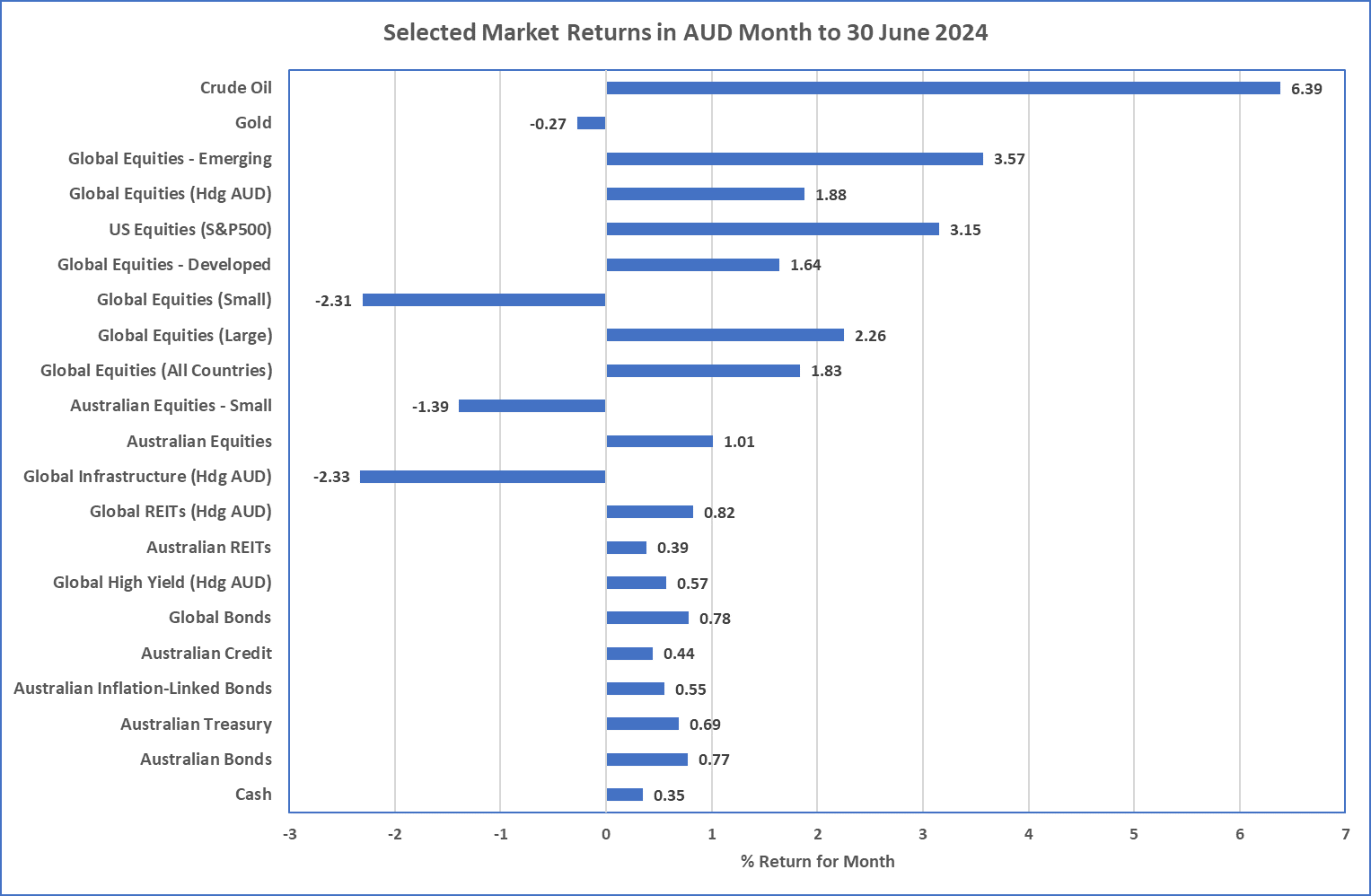

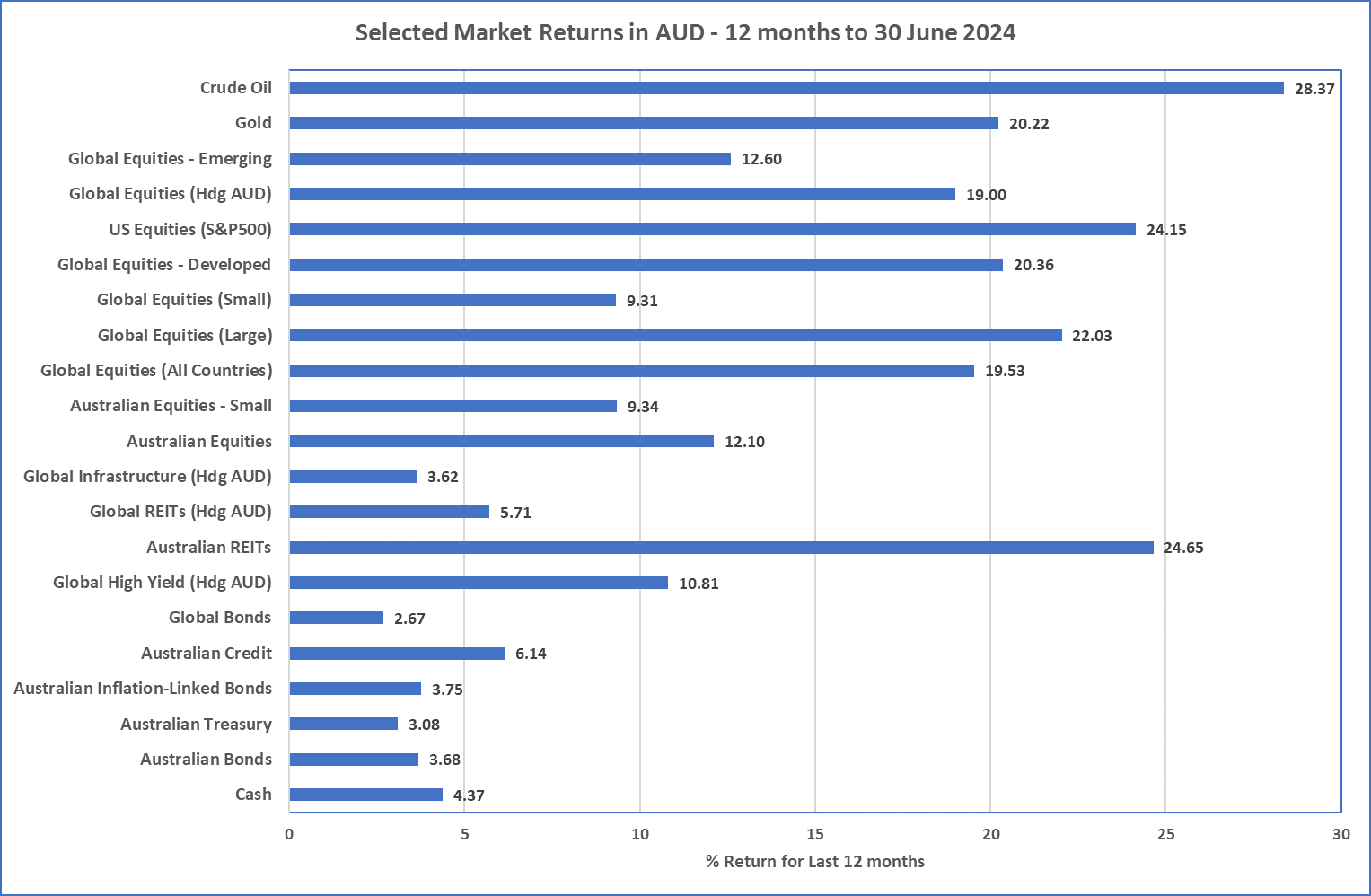

- Emerging Markets bounced a little to be the best performing asset class after being the worst in May and vice versa for Global Infrastructure. Momentum for risky assets has continued and the Artificial Intelligence stocks of the USA continue their strength showing little regard for valuations with prices suggesting double digit earnings growth for at least a decade.

- Inflation persists above desired levels in Australian and USA (3.6% and 3.3%, respectively), and recent economic growth around the world is generally low. The good news, economically, is relatively low unemployment, which does place upward pressure on inflation, but is very low in Australia (4%), USA (4.1%), and Europe (6.4%).

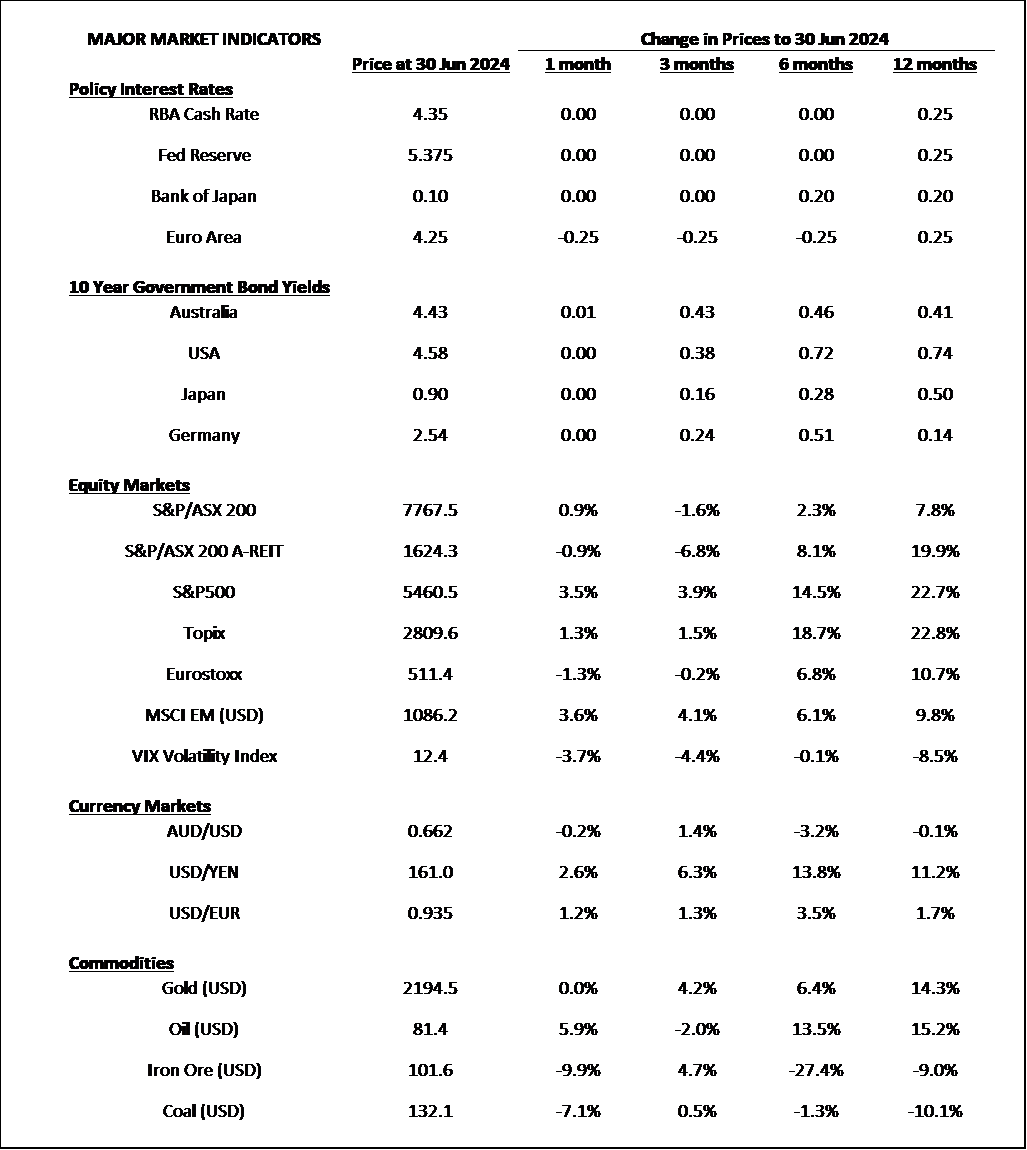

- Given USA and Australia are unlikely to reduce its cash rates in 2024, the European Central Bank (ECB) did reduce their cash rate by 0.25% in the first week of June, so proof (for the non-believers) that it will happen once inflation results are low enough. In Europe inflation is at 2.5%.

- Bond yield curves around the world continue to be sloped negatively which is not a strong economic indicator, and the higher cash rates are persistent and appealing for investors.

- For sharemarket investors the US sharemarket valuations are near record highs. This continues to be the investor’s biggest risk as high valuations tend to precede lower returns.

- There appear few strong buying opportunities across markets and investment portfolio preferences continue towards diversification across asset classes and securities. Lower valuation and higher quality continue as preferred overweights for the long term.

Chart 1: A good month for the diversified

Source: Morningstar

What happened last month?

Markets & Economy

- Central banks have been generally quiet for a little while now and have barely changed their interest rates. In June, that changed a little when the European Central Bank (ECB) reduced its headline cash rate from 4.5% to 4.25%. This makes sense as the European economy is largely stagnant, and their inflation has reduced to 2.5%.

- Whilst the economy shifts to become the ECB focus, the same is not yet true in USA and Australia, where inflation continues to prove a frustration for borrowers. Australia’s inflation stays above the Reserve Bank’s (RBA) target (2% to 3%) at 3.6% and the RBA does not expect it to return to target until 2025. IN the USA inflation is marginally better, 3.3%, but like Australia, services inflation is proving sticky (in USA, 5.2%; and Australia, 4.3%) suggesting rates will stay high until at least the end of 2024.

- Despite the high for longer theme, June produced very strong sharemarkets again. This time Emerging Markets (3.6%) and USA (S&P500 3.2%) were the best performers.

- While Global Infrastructure was the strongest performer in May, it returned to the weakest (again), returning negative 2.3%.

- All of that said, the main news topics in recent weeks were geopolitical with major elections in UK, France, and a disastrous debate performance by Biden increasing the chances of a Trump election win in November. Markets do not appear to have reacted significantly to any of these events.

Outlook

The message remains (literally) the same as last month …

- The paradox of markets and economies continues as high US sharemarket valuations persist in the face of high interest rates and slowing economies. The current sharemarket momentum may continue over the short term but longer-term growth at above-average levels appears increasingly unlikely.

- Uncertainty about persistent inflation suggests sharemarket volatility should increase but this is counter to current low levels of the S&P500 VIX Index (i.e. Volatility index). The risks around stagflation appear to be increasing and geopolitical risks around the Middle East continue.

- As mentioned last month, this doesn’t mean to change any long-term investment strategy, but it is important to ensure portfolios are well diversified to avoid/reduce concentrated risks or risks of the unknown.

- The Australian and USA central bank focus remains on inflation, and economic growth concerns are still secondary but increasing in importance. This may mean that when they believe they are ready to cut rates it will likely happen swiftly. For now, the Reserve Bank should keep rates on hold for the remainder of the year or, dare it said, increase rates if there are any signs of higher inflation.

- High Yield corporate debt does not appear to provide sufficient return for the risk, and we believe there are better places to achieve higher risk-adjusted returns, so for now our fixed interest preference remains higher quality investment grade debt. With Cash rates yielding higher than bonds, cash continues to appeal and remains the fixed interest king.

- Finally, investing with styles that favour value, quality (whether bonds or equities) appears appropriate but no matter the preferred market, portfolio diversification is crucial.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

Financial Year Asset Class Returns

Source: Morningstar

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710 600 | AFSL 560040