Market Snapshot: July 2024

In summary

A month for cheaper or more defensive risky assets

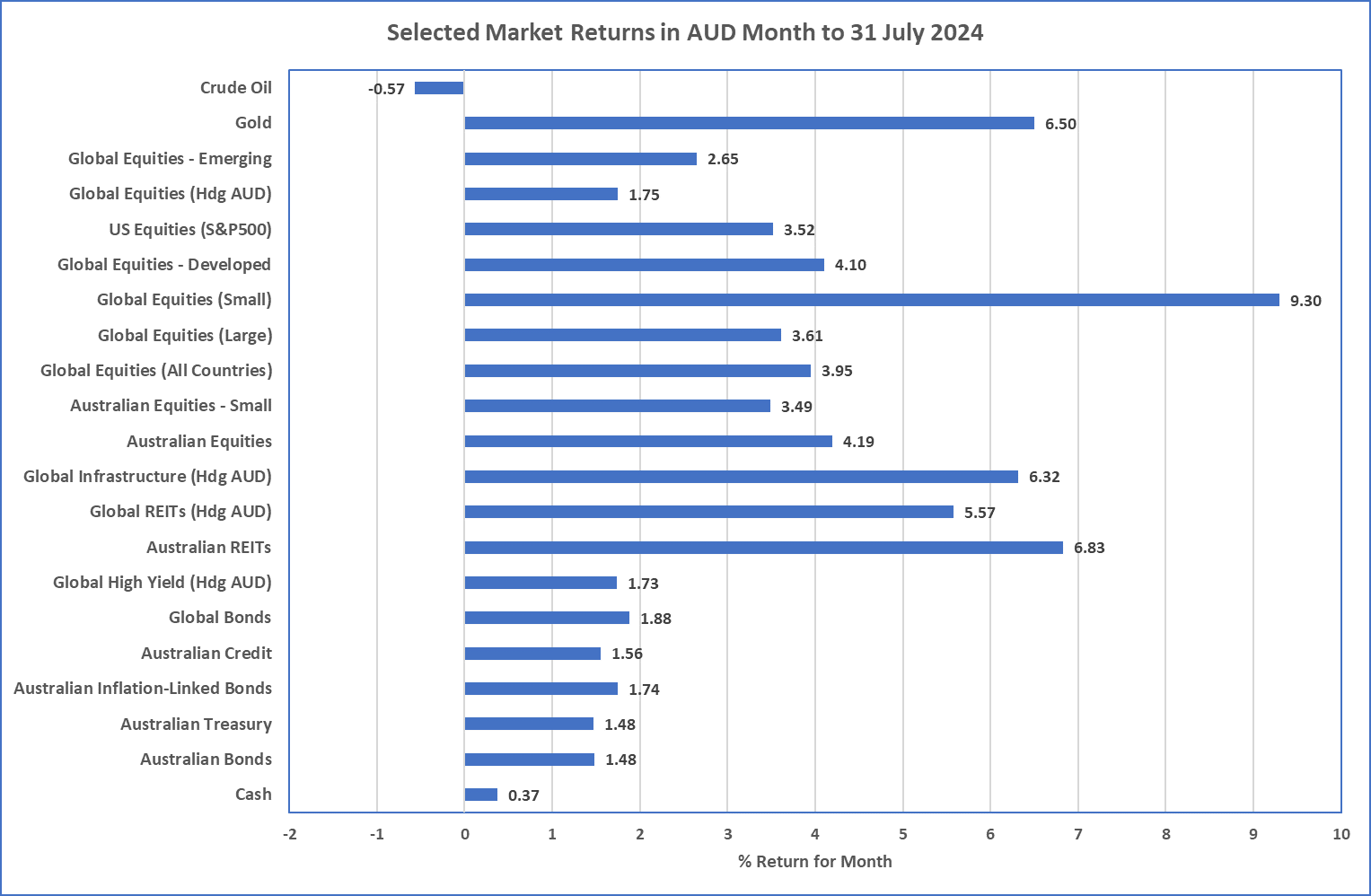

- As Chart 1 shows, most asset classes produced strong returns during July, so it was a good month for all or most investors. What is missing from this analysis is that many overseas sharemarkets actually declined and it is the weaker Australian dollar that made returns look better than they really were here in Australia … this is the occasional benefit of unhedged investing.

- This overseas market decline was in the back half of July and led by large US Tech companies. The market darlings, Microsoft, Google, Facebook, and NVIDIA, all declined by more than 5%, and this trend continued through the start of August.

- Whilst US (& other) markets started to decline; bond prices sharply increased (or bond yields declined). This has resulted in the major question market participants are currently asking … is this the start of a change in market regime from inflationary concerns to the economy. As mentioned last month, if higher inflation persists (and it recently has declined across most developed markets), stagflation may become the term DuJour. An economic slowdown generally means that bond become an essential diversifying part of investment portfolios.

-

Whilst this current volatility does provide some concerns, it has not changed the overall investment thesis …

- US sharemarkets continue as the most expensive in the world; Cash is appealing given it yields higher than longer term bonds; and diversification not concentration is essential. Preferences amongst shares continue to be value (i.e. cheaper than market) and higher quality but this may change if market continue to fall.

Chart 1: Almost all risk was paid well

Source: Morningstar

What happened last month?

Markets & Economy

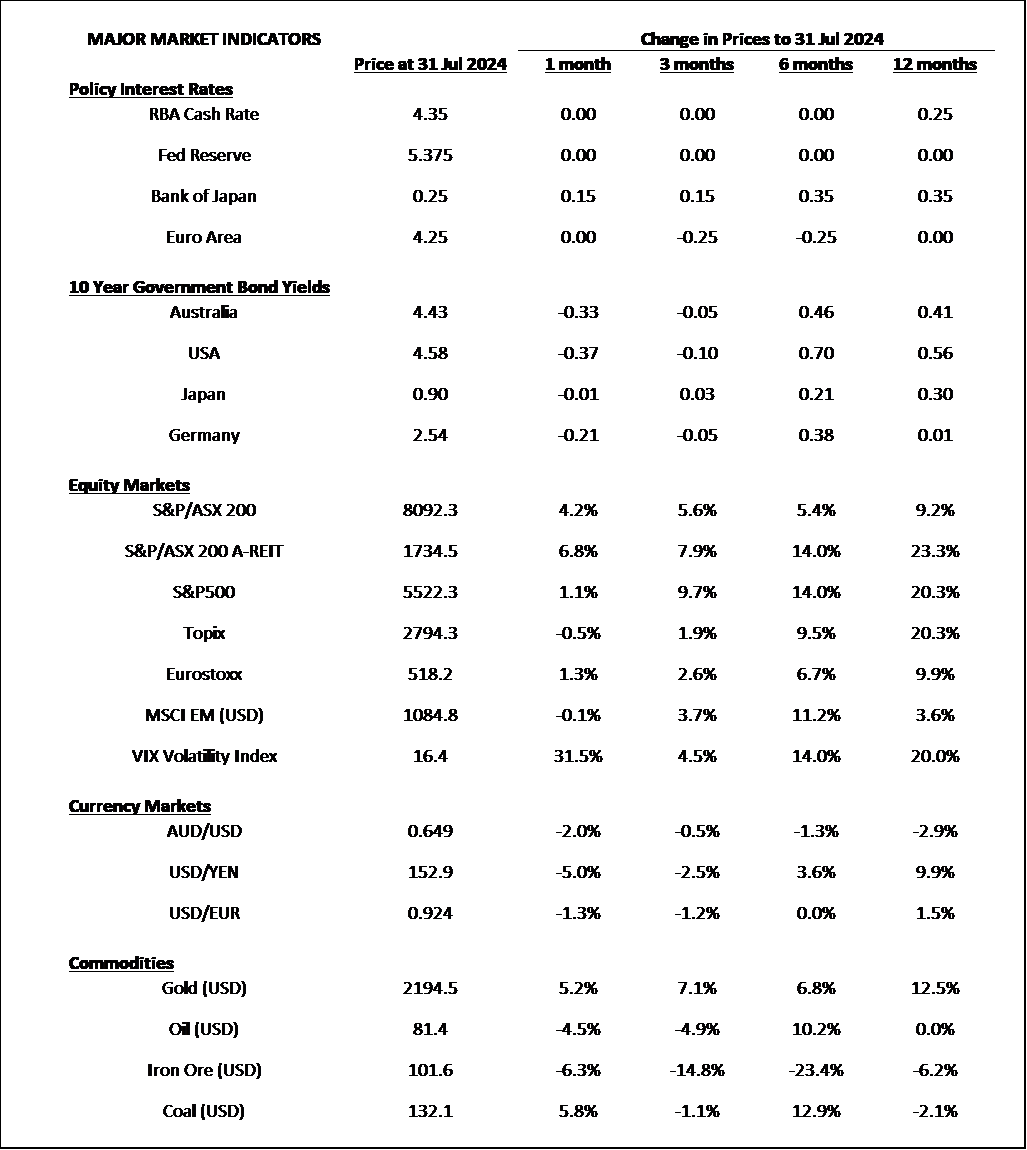

- At the end of July, Bank of Japan increased its cash rate by 0.15% to 0.25%, which is its highest level since the Global Financial Crisis in September 2008. Japan is currently experiencing its most sustained inflation in decades (latest inflation figure at 2.8%) so the rate rise appears justified.

- Anticipating this higher Japanese cash rate was the strengthening Japanese Yen. This is likely due to the unwinding of the famous carry trade whereby Japanese investors buy higher yielding foreign currencies like US Dollar and Australian Dollar.

-

The Australian Dollar also weakened against the US Dollar during July, and this is the primary reason for many of the positive

returns from Chart 1, because Global Shares hedged to Australian Dollar declined over 4% during July as the US market decline was

led by the expensive large US Tech stocks.

- Best performers over July included most defensive and value style investment strategies, and this included infrastructure, Real Estate, as well as the comparatively cheaper Emerging Markets and Australian sharemarket.

- Other catalysts for the high market volatility included an increase in US unemployment, which increased from 4% to 4.3%, and a lower inflation result of 3.0%, down from 3.3%. This combination suggests a weaker than expected US economy.

- Whilst US sharemarkets dropped in US Dollar terms, the bond market finally provided some diversification as bond yields significantly declined (meaning bond prices went up). Both Australian and US 10-year bond yields declined by more than 30bps diversifying the US Dollar losses for the first time since the higher inflation regime began.

Outlook

Has the economic and market regime changed?

- Whilst the short term is unpredictable, lower bond yields at the same time as lower US share prices may prove to be a turning point as attention and concern shifts from inflation to economic growth.

- The lower bond yields across both US and Australian markets have signalled inflation may be behind us shifting attention to when Central Banks will start cutting rates.

- Australia’s inflation, at 3.8%, is still stubbornly high and despite the lower bond yields, the Reserve Bank are still suggesting there is a chance of higher cash rates. From an investment perspective, these messages suggest that Cash is still king as its 4.35% yield may stay whilst longer term bonds are yielding well below 4%.

- Whilst sharemarket volatility was high in the back half of July across all markets, volatility is likely to continue throughout the second half of 2024, and the preferred investing styles are Value, and higher Quality (whether bonds or shares).

- If economic growth is increasing in concern, then High Yield continues to be a preferred underweight as the additional yield it offers is near record lows, not justifying its risk. The same is true for private assets for now. Private Assets are typically preferable during economic stress, when liquidity providers are in demand … but that’s not the case now.

- US sharemarket valuations are still high amongst high interest rates and slowing economies and longer-term growth at above-average levels appears increasingly unlikely.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

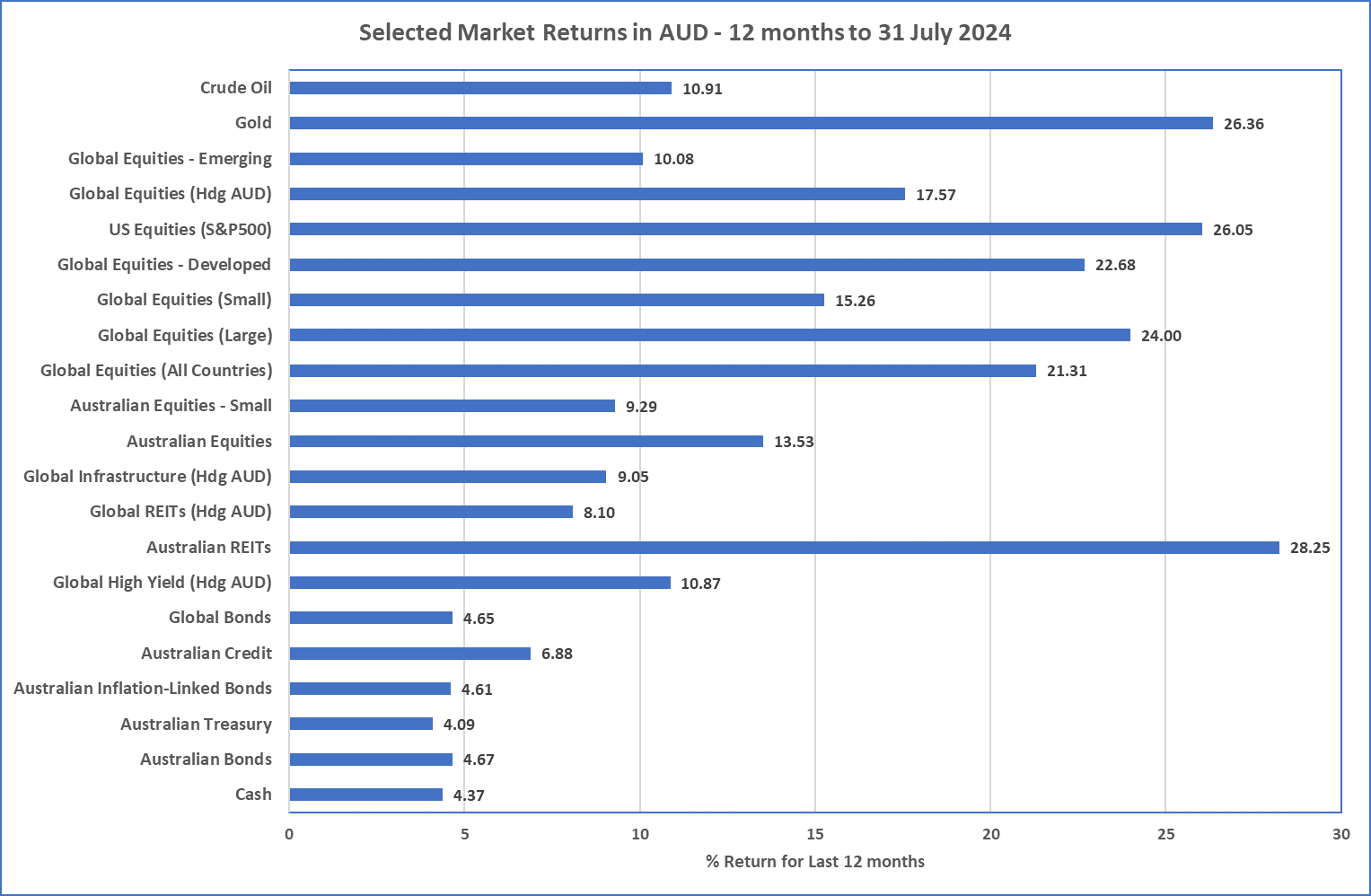

12 month Asset Class Returns

Source: Morningstar

With inflation below 4% in Australia, all asset classes have provided a positive real return over the 12 months to 31 July 2024.

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710 600 | AFSL 560040