In Summary:

A strong start to the year for most markets

-

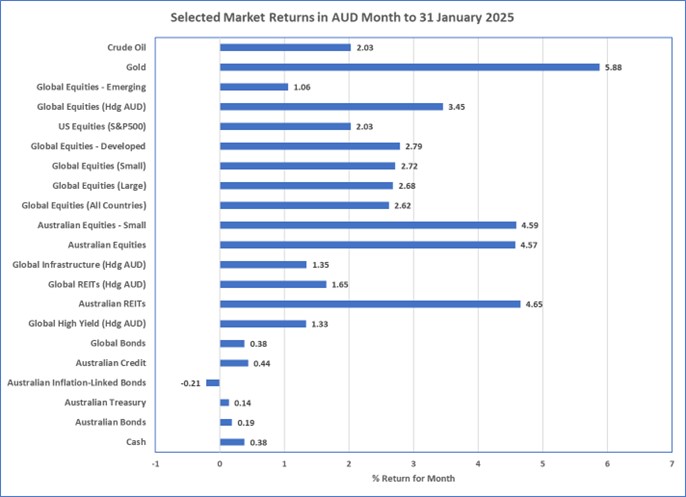

Cash, bond, and currency markets were somewhat uneventful during January finishing near where they started, whilst sharemarkets produced

small gains. Strongest returns came from the Australian sharemarket (which generally returned ~4.6%) and Gold (~5%).

- Gold is usually a hedge to many things (inflation, economy, US Dollar, sharemarkets, and volatility) but it has performed strongly alongside of similarly strong sharemarkets, which is not common.

-

The Trump administration commenced on 20 January and the President immediately launched a number of Executive Orders including trade tariffs

on both allies (Canada, Mexico) and foes (China). Markets responded negatively before returning to normal after some of the tariffs were

removed.

- Tariffs are unlikely to be good for the global economy, including USA’s, and initial market responses included a stronger US Dollar, lower sharemarket, and bond market volatility. Any future significant tariffs announced should expect this reaction again.

- Amongst major developed economies, including Australia, unemployment remains low, headline inflation is generally between 2% and 3%, and economic growth is relatively low but concerns about recession appear to now be a thing of the past. That said, the Chinese economy has no inflation and a relatively weak economy which may even worsen as tariffs are imposed in 2025.

- The core investment message remains the same and is do not chase the strong performer, maintain diversification, rebalance, and prepare for potential volatility as economies adjust to a the Trump-influenced world (although election promises rarely succeed). Major risks currently lie with expensive sharemarkets, particularly the USA, and global trade war as the USA ramps up it’s promised tariffs on friends and foes.

Chart One:

Source: Morningstar

What happened last month?

Markets & Economy

- Nearly all investment markets produced positive returns over January marking a good start to the year for all investors. The strongest returns came from the Australian sharemarket where the S&P/ASX 200, listed property and smaller company indexes all returned around 4.6%. The perceived hedge to everything, Gold, provided a 6% return indicating a potential increase in uncertainty from the potential high tariff and chaotic world of the new USA administration.

-

The global economy produced more of the same as previous months;

- Headline inflation in USA, Europe, and Australia hovers between 25 and 3%, services inflation is generally high (>4%) and Chinese continues to experience no inflation as its economy continues to struggle.

- Economic growth measures continue to be strongest in the USA, with Australia, Europe, and China muddling along.

- That said, unemployment is generally low; USA and Australia is 4%, China is 5.1%, and Europe is around 6.3% which is near record lows.

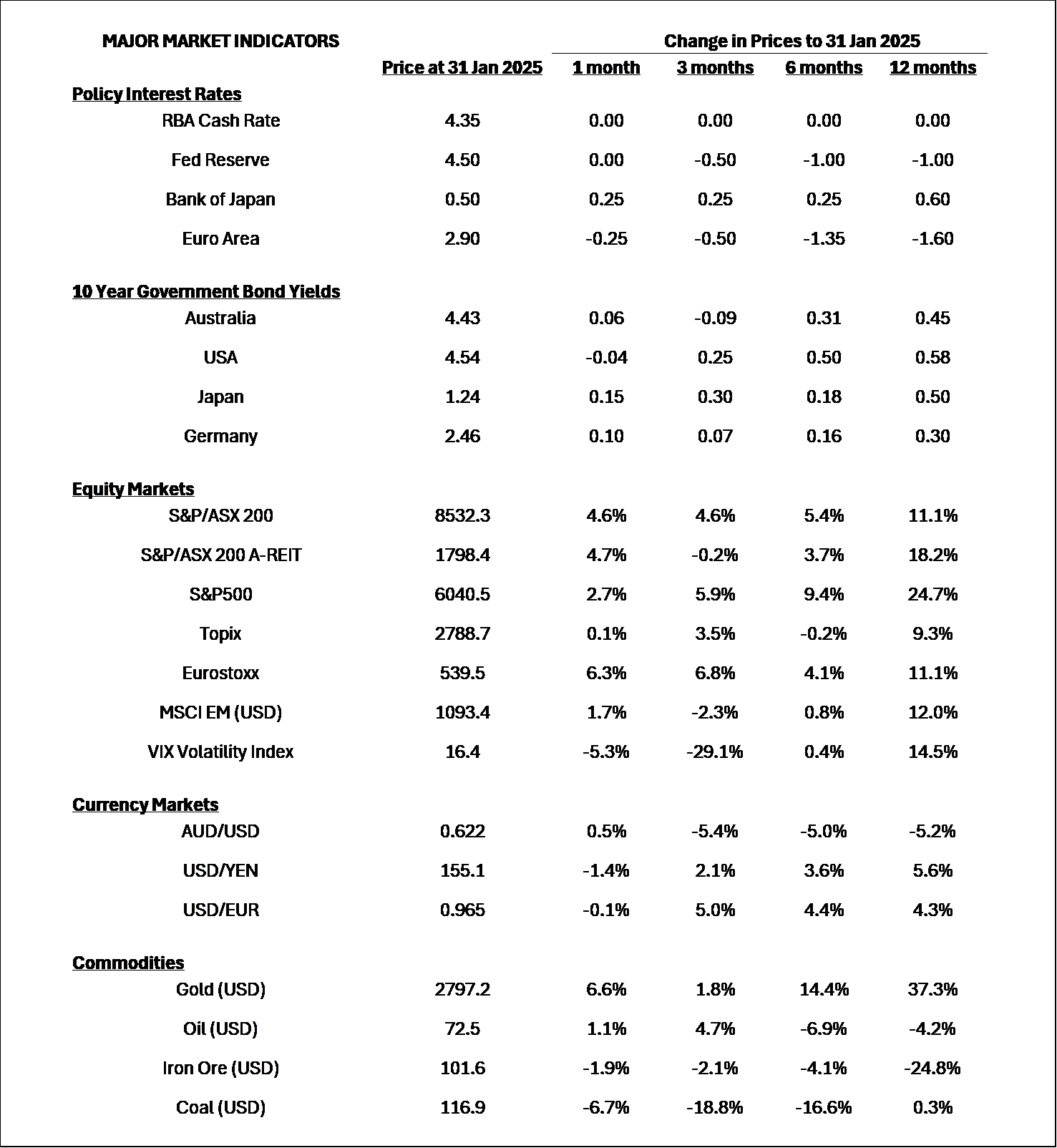

- There was a little central bank action in January including the European Central Bank dropping its cash rate by another 25bps to 2.9% and the Bank of Japan increasing their cash rates by 25bps to 0.5% which is its highest level since the GFC in 2008.

- The Australian dollar ended January near where it started at $0.62USD, although dropped around 2% when Trump announced his Tariffs on Canada, Mexico, and China … perhaps a sign to come.

Outlook

-

Most of the paper talk and market behaviour is centred on the flurry of executive orders coming from the new Trump presidency. Tariffs were

announced on Colombia, Canada, Mexico (apparent allies), and China, with some of them quickly removed after promises to assist on

immigration issues.

- So far, the impact of the Tariffs have been increased market volatility, loss of trust in USA as previous agreements have effectively ripped up, and a stronger US Dollar.

- Most economists are of the opinion that tariffs will increase inflation which surely must happen as the lowest cost producer has additional taxes imposed on them.

- Market volatility should be accepted but market direction is impossible predict as tariffs are likely to be economically damaging, thereby reducing demand, at the same time as they help specific companies.

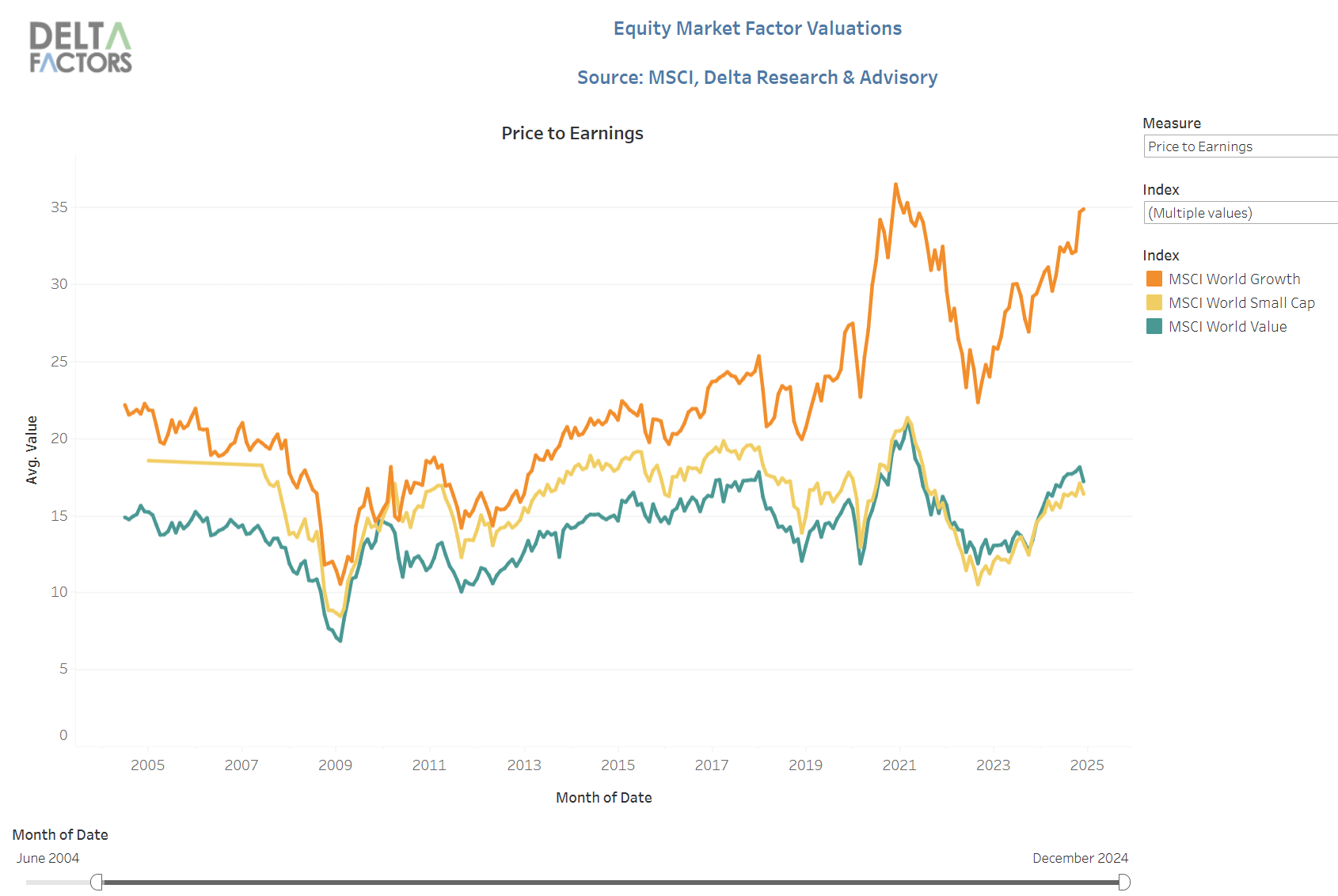

- Another area of concern has been the much-written about valuations of the US sharemarket. The announcement of new AI technology from the Chinese boutique company, DeepSeek, resulted in a 15% one-day drop in share price of Nvidia. This demonstrates the fragility of valuations in this AI boom, and with 1990s tech-boom-like valuations today, it is difficult to see the continuation of the massive returns seen over the last 10 years by the large US tech companies. This is a key risk that cannot be ignored.

- In Australia, markets suggest the RBA are near guaranteed to reduce interest rates in mid-February providing small relief to mortgage holders.

- Overall, the general portfolio approach is unchanged and centres on diversification. Volatile markets are likely over the next few weeks or months and diversification continues to be essential in this environment; whether shares, bonds, real assets, as well as across regions and broader asset class levels.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

Valuations - Global Growth vs Value and Small Caps

Source: MSCI and Delta Factors

Global Growth is now around double the PE ratio of Global Small and Global Value

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040

General Advice Warning

The information provided in this article is for general information purposes only and is not intended to and does not constitute formal

taxation, financial or accounting advice. McConachie Stedman does not give any guarantee, warranty or make any representation that the

information is fit for a particular purpose. As such, you should not make any investment or other financial decision in reliance upon the

information set out in this correspondence and should seek professional advice on the financial, legal and taxation implications before

making any such decisions.