Market Snapshot: January 2022

In summary

-

Its all about inflation as all major asset classes drop around the world and equity markets increase in volatility as high inflation results

hit USA (7%) and Europe (5.1%).

- US equity markets, particularly tech companies, are repricing as the higher inflation potential and higher interest rates suggest that valuation matters. This higher volatility is impacting all markets and is likely to continue over the short term.

- COVID-19 is still a strong presence but is starting to shift to the background again and this is thanks to the combination of a very high population gaining some level of immunity either naturally (from the very high cases) or from vaccines. Many experts are starting to debate the end of the pandemic which is a good sign for global borders opening, increased travel, and some sort of return to a normal economy (although there is plenty of water to go under the bridge yet).

- Geopolitical risks currently reside around Ukraine and Russia and for now this appears to be affecting energy prices, evidenced by high Oil prices. Russia is a massive energy supplier via Natural Gas, to Europe and this has also increased in price.

- Looking ahead, investment portfolios should remain widely diversified, avoid concentrated risks, and continually rebalanced to strategic positions. The current equity market sell-off may be a rebalance opportunity to purchase equities as a lower price than over the last couple of months.

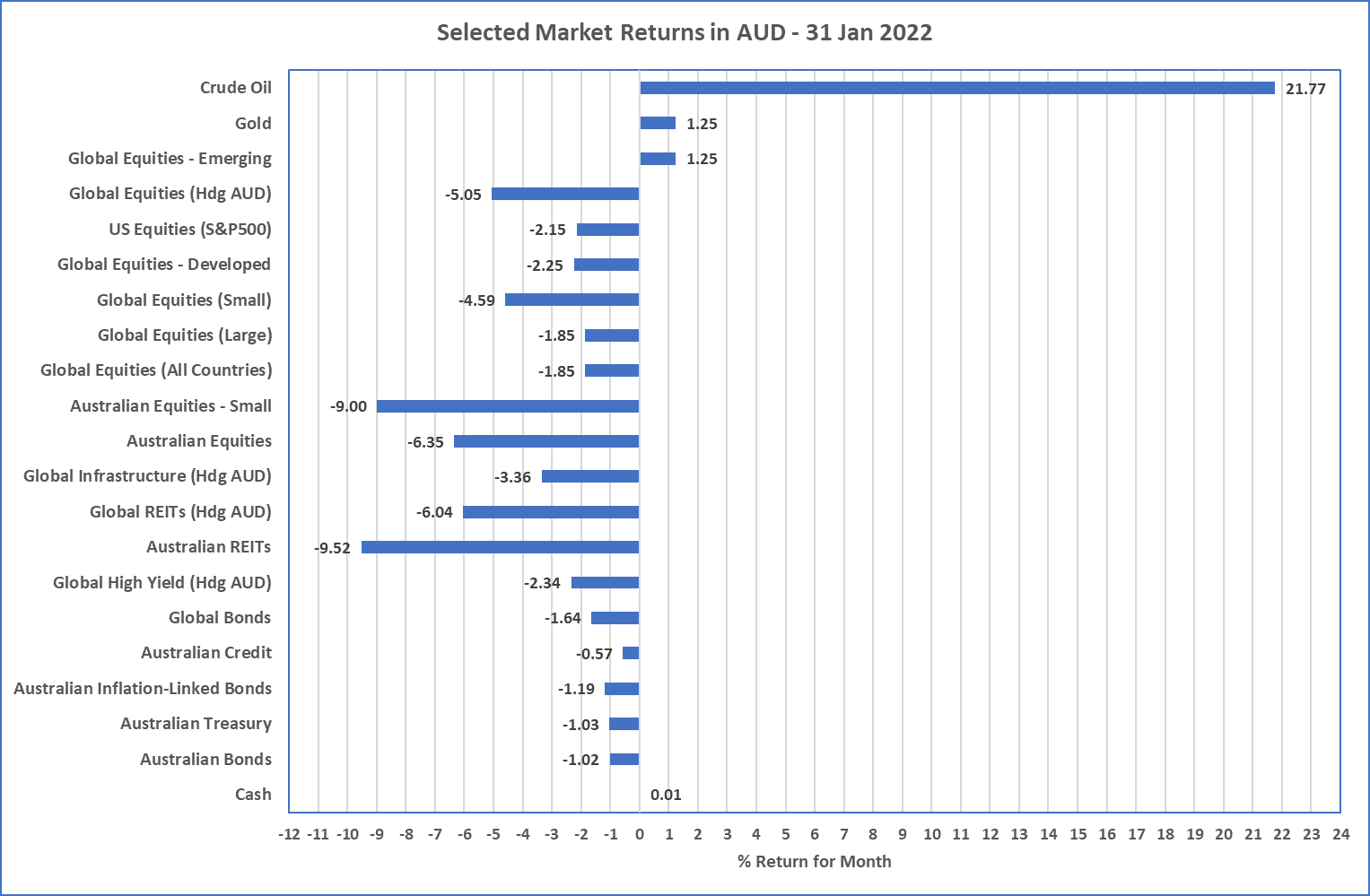

Chart 1: A month for Real Assets

Sources: Morningstar

What happened in December?

Pandemic

Australia loses some control

- The opening of Australia has proven to be a medical disaster as the highly contagious Omicron sets records for new cases, hospitalisations, and deaths in most states (except Western Australia).

- There are supply chain problems around the world, that are related to COVID-19 in one way or another, but the massive case acceleration from Omicron has resulted in staff shortages and added to lowering expected economic growth in Australia and the rest of the world.

- The current hope is that the acceleration of Omicron cases bring us closer to herd immunity when combined with vaccination as both natural and artificial immunisation has increased significantly.

Markets

So much for diversification

-

The month of January saw every asset class decline in value with the exception of Cash, some commodities, and Emerging Markets.

- The rise of inflation expectations produced a rise in many interest rate markets that also placed pressure on securities with high valuations. Whilst it's been a while, January 2022 is month that showed valuations still matter.

- Whilst Emerging Markets was the only equity asset class that produced a positive return, it was a reversal of some weaker performance from previous months.

-

Despite being defensive assets, bonds were down across the board … high interest rates mean higher prices and if inflation persists higher

volatility may come too.

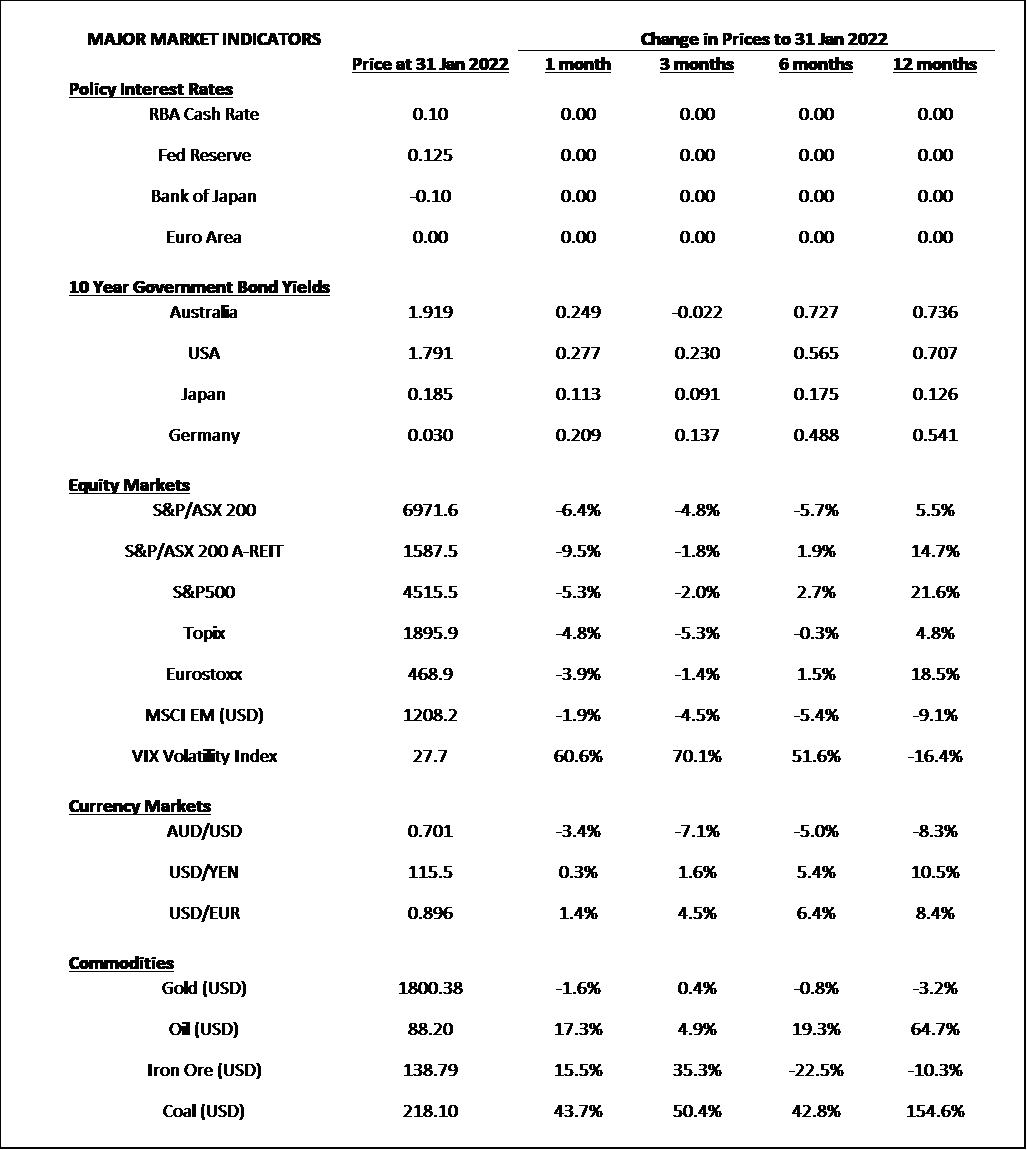

- Markets are currently positioned for increased cash rates in March in the USA but not until the latter half of 2022 for Australia.

- One of the bigger contributors to inflation, Oil, was up over 20% in January and this was also likely due to the energy supplier to Europe, i.e. Russia, preparing for potential invasion of Ukraine.

Economies

Inflation still high with mixed economic results

- The economic situation appears to be largely centred on inflation expectations. Recent high Inflation has come from the combination of supply chain constraints and an increase in demand for goods (as opposed to services). Central Banks believe these issues will continue over the first half of 2022.

- Employment appears strong across the developed world and this is adding to inflation pressures as wage inflation increases. USA unemployment is 4% and Australia’s 4.2%

- Finally, the continued opening up of economies and settling down of Omicron cases still augurs well for global economic growth in 2022, although the massive spread of Omicron has still resulted in some short-term revision downwards in first quarter economic growth expectations.

Outlook

- Higher inflation, potential increasing interest rates, along with tight credit markets adds up to a sensitive equity market that may maintain their higher than usual levels of volatility during 2022.

- Valuations are still relatively high in the USA so the higher interest rates could continue to provide a revaluation, and this may also flow into some other markets.

- From an economic perspective, positive economic growth looks likely as employment is tight and people spend to avoid being caught out by potential inflation.

- From an investment portfolio perspective, the major them continues … increased diversification and rebalancing when markets are down.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619