Market Snapshot: February 2023

In summary

Cash rates continue upward!!!

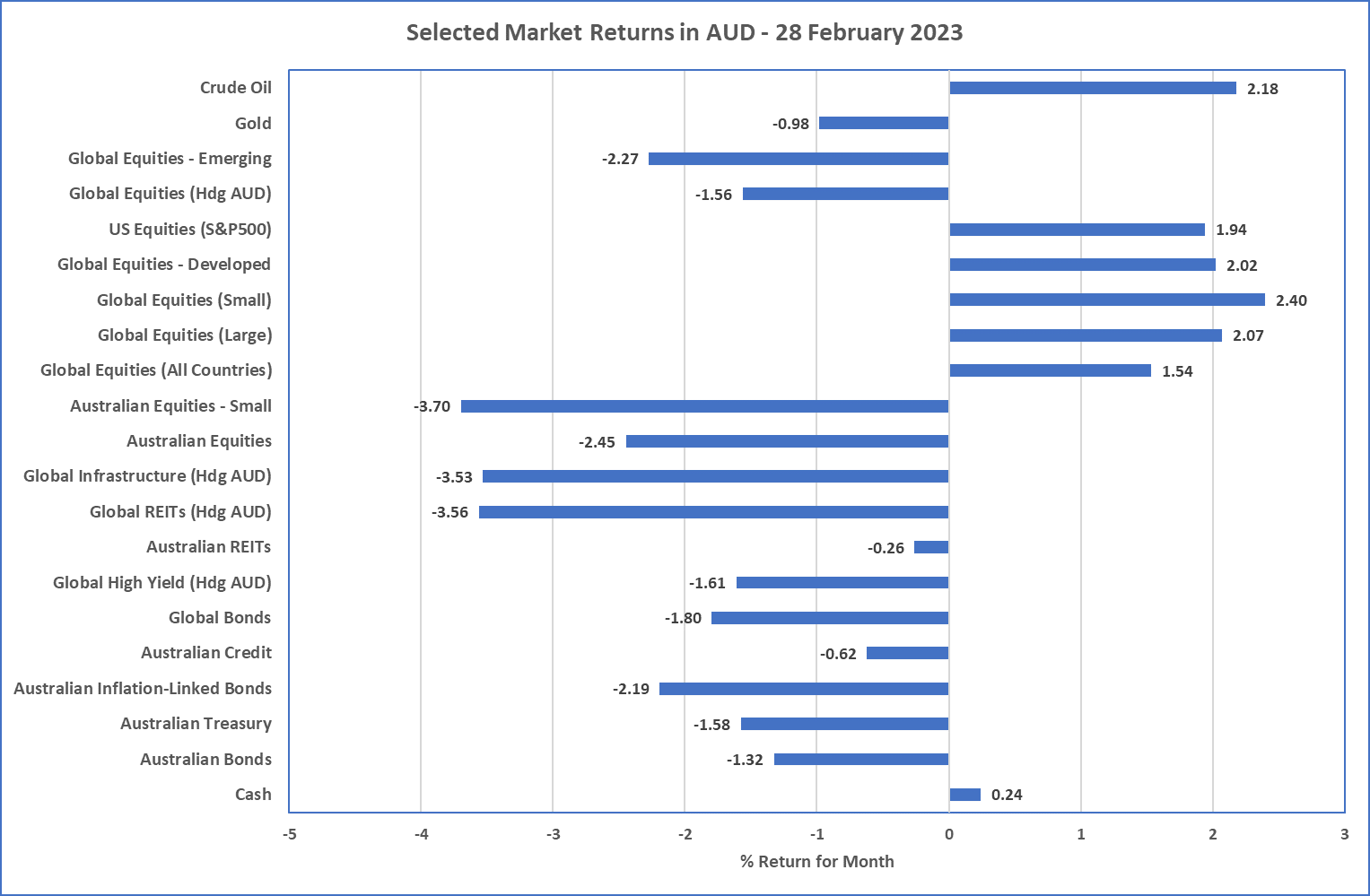

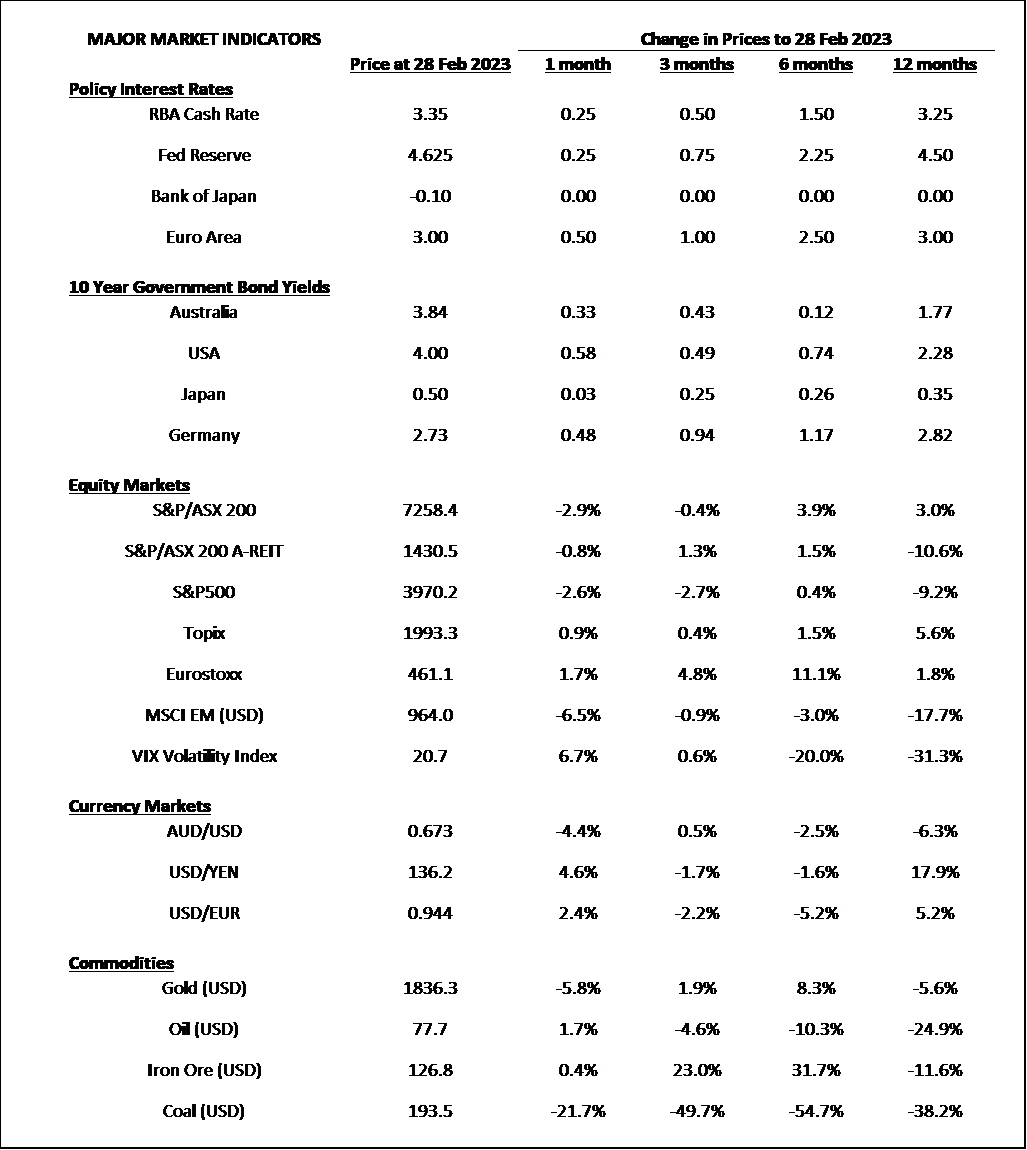

- It’s still largely about the USA and the belief that inflation is persisting longer than previously indicated. This means cash rates are going higher and the Federal Reserve Bank’s determination to slow the US economy is getting stronger. This meant bond yields increased again (therefore prices went down) and some fear returned to sharemarkets and recently declined.

- The saviour of investment returns for February was the weak Australian dollar which declined against the US Dollar by around 4% thereby giving around a 4% boost to unhedged global equity returns. All other asset classes declined (except Cash, Oil)

-

Looking ahead, our market expectations are unchanged from previous months and we continue to be cautious on equity markets. Expectations are

for sustained investment market volatility across all asset classes as the global economy slows during 2023.

- From a valuation perspective, we prefer to be underweight in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

- High quality securities (defined by good profitability and strong balance sheets) may provide some recession protection.

- We are neutral on bonds as their yields are similar to Cash but, unlike recent times, believe Bonds will provide some protection to equity market volatility in 2023 and the horrible returns of 2022 for bonds are largely behind us.

Chart 1: A weak Australian dollar helped unhedged positions

Sources: Morningstar

What happened last month?

Markets & Economy

Australian Dollar was the big mover

- After a very strong January for equities, February started off well but almost all asset classes ended in negative territory as continued concerns about the US economy persisted thanks to the Federal Reserve continuing its determination to slow the economy.

- The Australian dollar turned out the difference as it declined against the US Dollar by over 4% thereby turning negative global equities returns of almost 2% into a positive return of around 2% if holding unhedged positions. This is because unhedged global equities are mostly held in US Dollars, so a weak Australian dollar is usually beneficial to returns.

- With concerns about the Federal Reserve raising rates, bond yields increased meaning declines in bond market prices and high debt-owning asset classes such as property and infrastructure.

- The hawkish stance by the Federal Reserve is due to persistent inflation and a determination to slow the economy and reduce wage inflation that also seems to persist in the USA.

- In Australia, the inflation rate stayed at its multi-decade high of around 7.8% and essentially forced the Reserve Bank to increase its cash rate again. After its early March meeting the cash rate increased to 3.6% and futures markets suggest its not going to stop there … By the middle of 2023, 4.1% appears to be the likely cash rate peak…so another 0.50% of hikes to come.

Outlook

Economic decline

- Unfortunately, the bond market in the USA continues to point to recession and with equity markets recently increasing their volatility it seems this may continue for some months yet.

- Inflation has shifted from goods to services, and high inflation is likely to continue both here and around the world whilst unemployment is low, and companies look to increase prices because they can whilst any economic strength remains.

- From an investment perspective we remain cautious. Current bond prices do not provide any strong preference for bonds over cash, so the preference is to be slightly overweight cash (or short interest rate duration) as cash interest rates are relatively high and they still appear to be increasing over the short term.

- Considering recession in the USA is still a strong possibility, erring on the side of caution also means we prefer higher quality bond securities over high yield as expectations are that high yield securities have significant downside risk, along with equity markets.

-

So, at the risk of being a little repetitive, the outlook is unchanged from last month and we continue to believe the following during 2023:

- Downgrades in corporate earnings, increase in unemployment, continued weak Australian dollar, and continued downturn (albeit at a slower rate) in property prices.

- Volatility for bond and equity markets … although the return outcome of bonds will not be as bad as 2022. USA equity markets are most expensive around the world so at most risk for further downgrades.

- Widening of high yield spreads and likely negative returns for high yield. High Yield bonds are not priced for any likelihood of recession and although spreads widened in 2022, they appear far from levels that present reasonable risk.

- Value stocks to outperform growth stocks again as valuations of global growth securities (which are mostly in the USA) continue to be very high.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619