Market Snapshot: December 2024

2024 summary

A risk-on year

- Most major countries of the world produced relatively weak economic growth in 2024 with the exception of the USA (+3.1%), clearly the dominant global economic growth driver.

- Inflation has steadied everywhere with most major economies showing headline inflation below 3%. That said, the second largest economy, China, is struggling with deflation and their latest figure was 0.2% … economic troubles following the bursting of their property bubble.

- Whilst economic growth has been generally weak, unemployment has stayed relatively low. Japan’s is 2.5%, Australia, UK, and USA’s unemployment fluctuates around 4%, China’s is 5%, and the Euro area at 6%, which is amongst it’s lowest ever.

-

With inflation at tolerable levels most major central banks reduced their rates in 2024. This included the Federal Reserve (down a total of

100bps in 2024 to 4.5%), European Central Bank (down a total of 135bps in 2024 to 3.15%), and the Bank of England (down 50bps to 4.75%).

- The exceptions are Bank of Japan who have increased their cash rate by 0.25% from 0.1% after experiencing decades of deflation, and the Reserve Bank of Australia who remains unchanged at 4.35% (and currently expected to decline in February 2025).

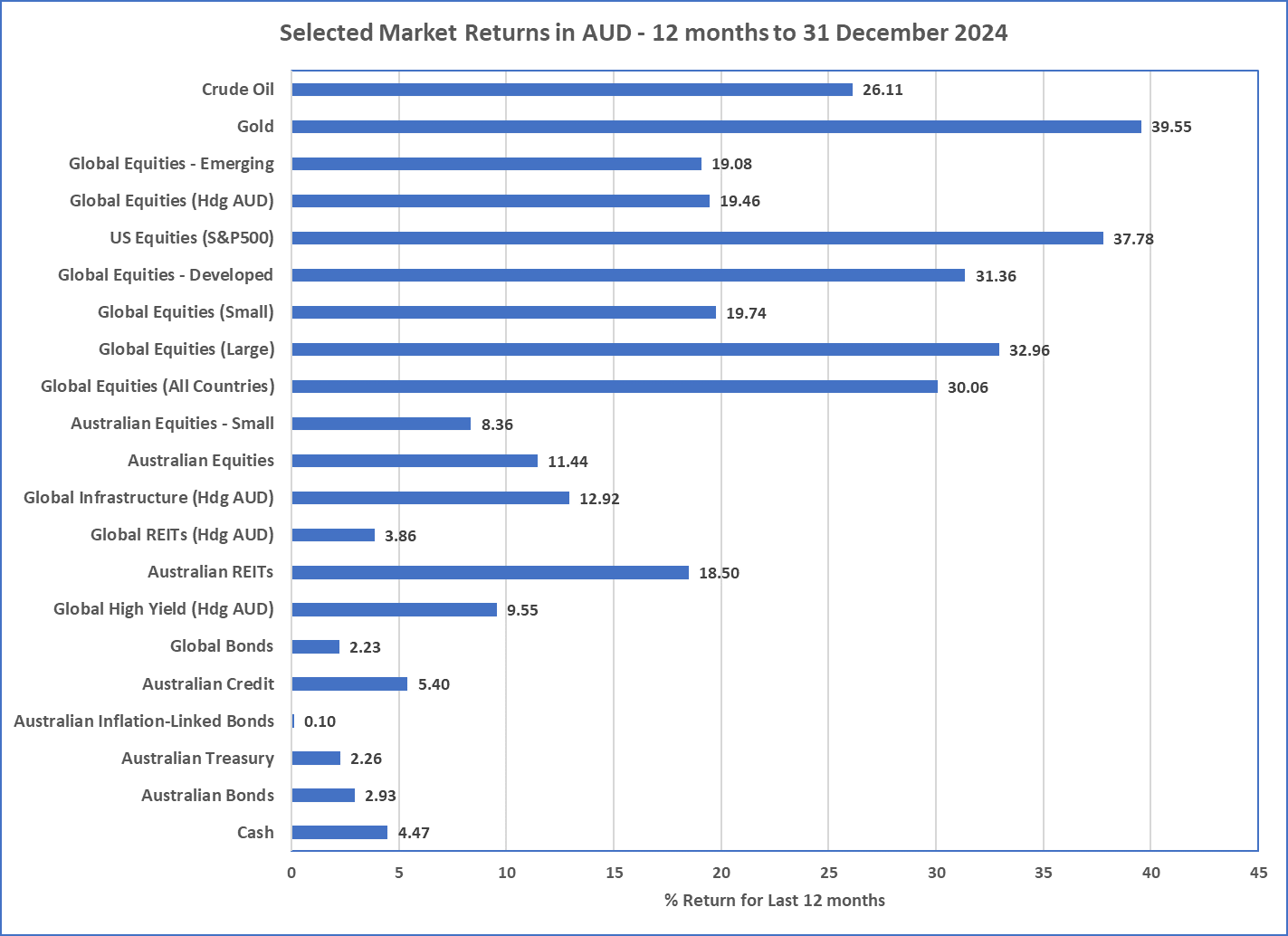

- In terms of 2024 market returns, cash and bonds were positive but generally below 5%. It was a “risk-on” year for the second year in a row and most sharemarkets were above 10% with the standout being the US market again which returned over 30% in Australian dollar terms. Bitcoin returned 133% but its possibly worth noting that Fartcoin returned over 1,000% so rational behaviour still appears rare in crypto-land so continues to be not recommended.

- The core investment message remains the same and is do not chase the strong performer, maintain diversification, rebalance, and prepare for potential volatility as economies adjust to the Trump-influenced world (although election promises rarely succeed).

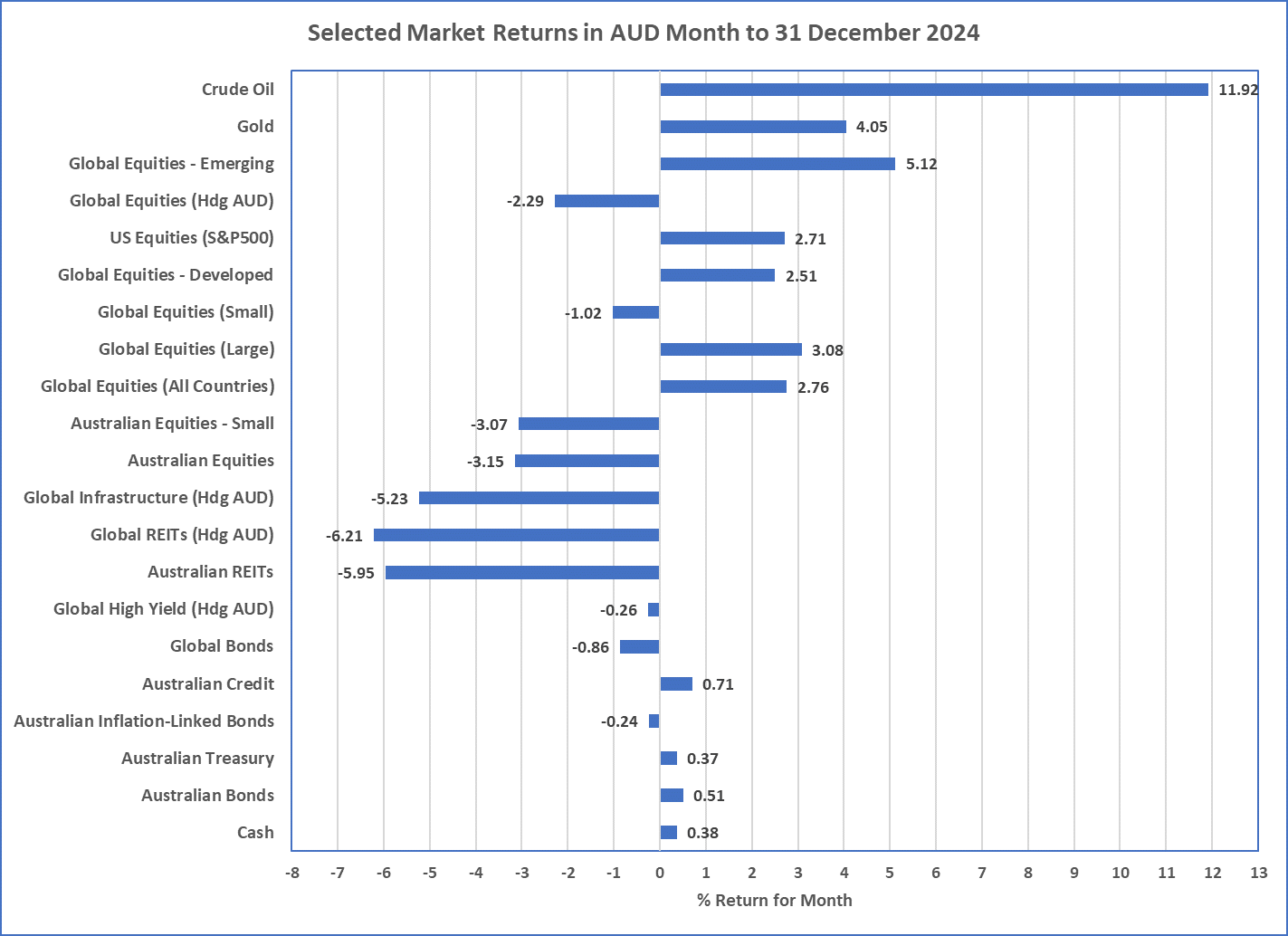

Chart 1: US dollar strength hurts global hedged assets most

Source: Morningstar

What happened last month?

Markets & Economy

- The Federal Reserve reduced their cash rate by another 25bps during December bringing it down to 4.50% bringing total rate cuts since August to 100bps. Unlike November, the European Central Bank (ECB) also reduced their cash rate by 25bps, bringing their interest rates down to 3.15%.

- Latest headline inflation is between 2% and 3% for some of the major capitalist economies of the world including USA (2.7%), Euro Area (2.4%), United Kingdom (2.6%), and Australia (2.8%). There are many other large countries whose latest inflation is below 2% including China (0.2%), Canada (1.9%), France (1.3%), Italy (1.3%), and South Korea (1.9%) … all suggesting the inflation problem of the last couple of years is almost finished …although high services inflation persists in Australia and USA (>>4%) keeping central banks on their toes.

-

Economic growth continues to be generally weak around the world and in Australia (Sep 2024 economic growth is at 0.3%). The main driving

economic force continues to be the USA, and their latest economic growth result was a strong 3.1%.

- US Markets spluttered a little in December although still returned almost 3% in AUD as the US Dollar strengthened considerably.

- The Australian Dollar ended 2024 trading around $0.62USD which is near its lowest level for several years.

- Whilst inflation appears largely an issue of the past, central banks are painting the picture of sustained inflation and the bond market was volatile during December and bond yields crept up in USA, as they also brace for the inflationary impacts of some of Trump’s policies (including Tariffs).

Outlook

- Major professional investment firms around the world are increasingly talking about the high valuations of USA sharemarkets which, as mentioned each month here, have been high for some time.

- Inflationary economic policy from the new Trump administration is one of the bigger threats to the USA sharemarket. This would create greater market uncertainty, potentially increasing flow to US Dollars as safe haven investing increases naturally increasing the US Dollar. This would then contrast with the US government’s desire for other countries to purchase USA goods and services as a strong US Dollar means they are more expensive.

- That said, the current short-term trajectory of interest rates appears down. The latest market indications in Australia are that the RBA is likely to reduce rates by 25bps in February 2025 and this is a sharp reversal from previous projections of mid-2025. That said, it is likely that interest rate reductions will be relatively slow and currently appear to be no more than 100bps by end of 2025.

- As a result, the general portfolio approach is unchanged and centres on diversification. Short term momentum of the “risk on” sharemarket has slowed but may re-continue over the next few weeks or months, diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels.

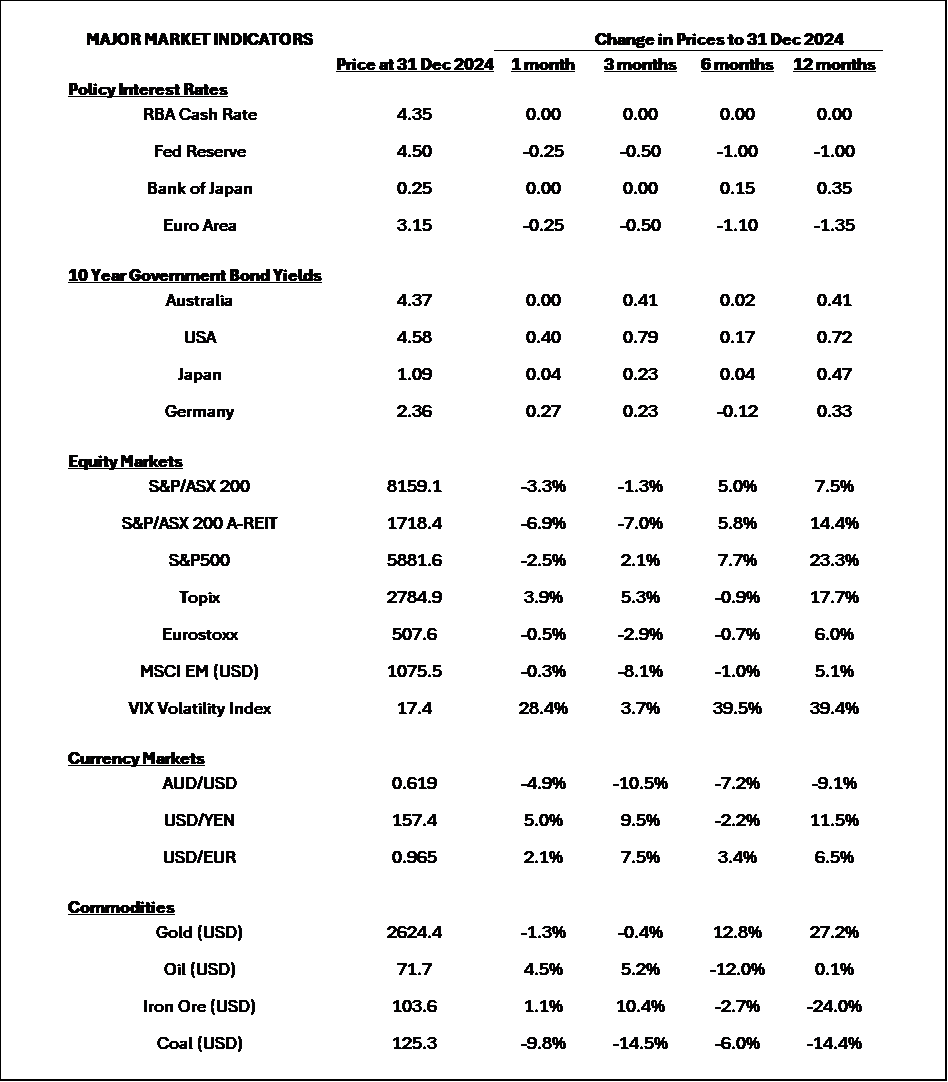

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

2024 Asset Class Returns

Source: Morningstar

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710

600 | AFSL 560040