Market Snapshot: August 2024

In summary

A month for cheaper or more defensive risky assets

-

A mixed month for August, where most equity markets lost money and diversification finally returned with positive returns from bonds and

listed real assets.

- The main concerns appeared to be potential economic decline in the USA whereby inflation dropped relatively sharply whilst unemployment rose more than expected.

- Japanese sharemarkets performed weakly too as the yen rose alongside their interest rates.

-

Much of the developed world have started reducing their cash rates and the USA’s Federal Reserve is expected to start reducing their cash

rate by at least 25bps by February 2025.

- The same can’t be said for Australia as the Reserve Bank are still concerned about inflation and have stated their intention to keep cash rates high into 2025.

- Australia has produced relatively weak economic growth in 2024, and this trend is expected to continue whilst rates stay high. That said, with the rest of the developed world reducing rates, Australia will inevitably follow suit in 2025, asking the question whether longer duration (or boring bonds) should play a bigger part in portfolios today.

- We have said many times that the US sharemarket is expensive, with Global Quality (i.e. low debt, consistent profitability, and US dominant) at its most expensive for many years, whilst Value and Smaller Companies appear relatively cheap. The core investment message remains the same and is do not chase the strong performer, maintain diversification, and prepare for potential volatility as economies slow from these higher rates.

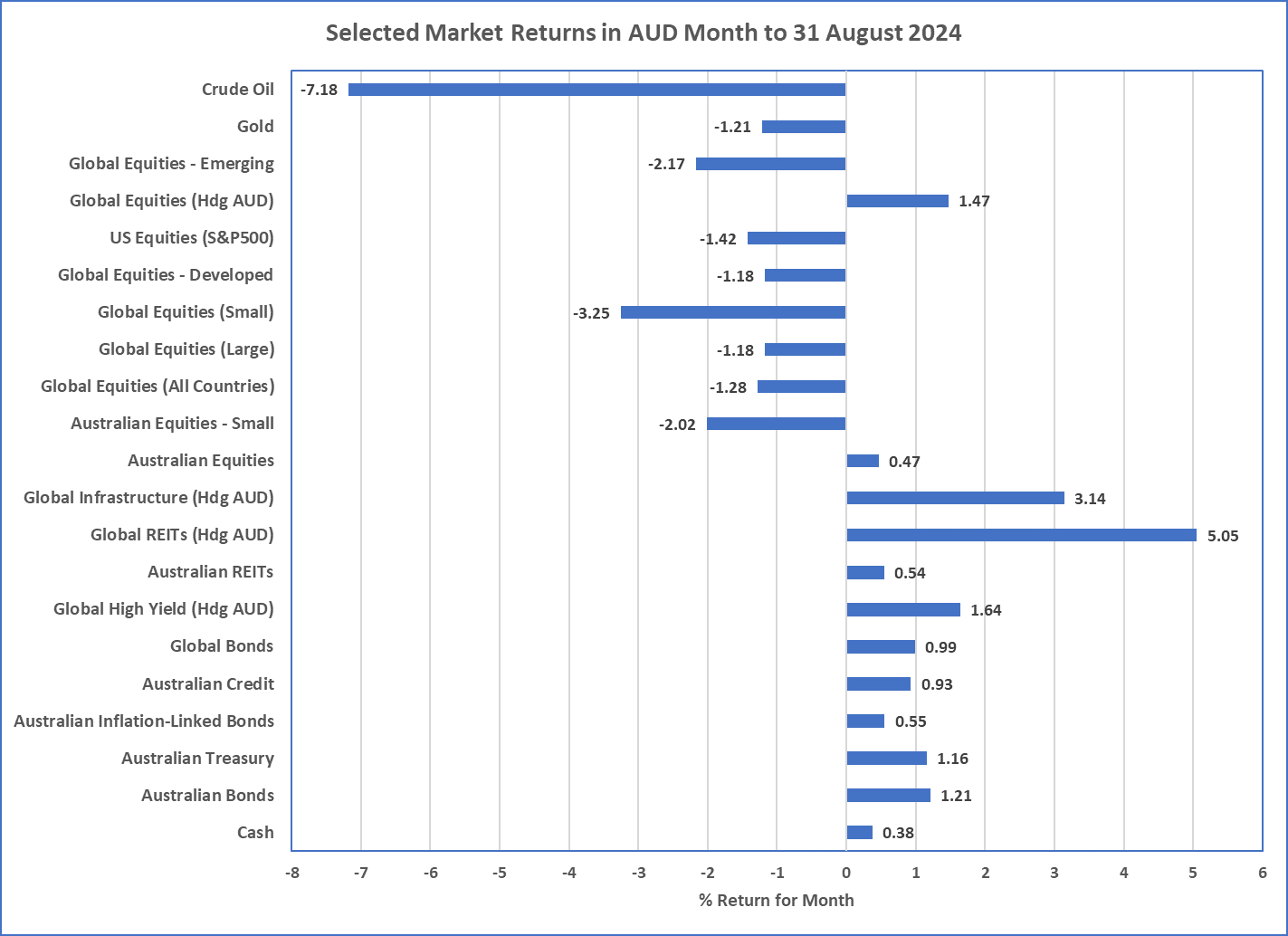

Chart 1: Bonds and Real Assets show their diversification potential

Source: Morningstar

What happened last month?

Markets & Economy

- August was a challenging month for sharemarket investors as Japanese equities had their biggest one-day crash since the 87 crash, after the yen rallied and interest rates increased, and US technology stocks sold off in the first week before coming back a little.

- At the end of August, global sharemarkets produced small losses but it was initially looking like being much worse as the early August selling was very strong.

- One of the main reasons for the selling of risky assets was the potential start of regime change as the market focus shifted from inflation to economic concerns. In the US, inflation dropped relatively sharply from 3.3% to 3.0% and unemployment continued its increase jumping from 4.1% to 4.3%. This combination suggested an economic slowdown is underway; hence the sell-off in shares, but it is safe to say that it is still way too early to be making a recession call when there is mixed data.

-

For the first time in a while, bonds and real assets showed their diversification abilities during the sharemarket sell-off of the first

week and over August overall. Both bond and listed real asset prices went up as the sharemarket declined.

- As Chart 1 shows, the best performing assets over August were the long duration Global REITS (up 5%), Global Infrastructure (up 3.1%), and Australian and Global Bonds (up 1%).

- Whilst inflation concerns may be shifting to a secondary issue in USA, Europe, and other developed nations, in Australia it is still the primary focus. Australia’s inflation continues at an uncomfortable level (3.8%), and the Reserve Bank indicated they are unlikely to reduce their cash rate until 2025. The latest economic growth figure was weak (0.2%), and a continued weak Australian economy in the face of persistent higher rates should be expected.

Outlook

Has the economic and market regime changed?

- The focus appears to be shifting to the economy over inflation meaning lower interest rates are more likely. At the time of writing, the Federal Reserve is expected to reduce its cash rate by February 2025 so one of the questions now, is do they drop 25bps or 50bps?

- Either way, longer duration bonds are likely to play a stronger role in investment portfolios as both diversifiers and consistent income providers. Whilst Australia’s Reserve Bank may not be reducing rates in the short term, they will inevitably follow suit, and it is probable that many investors will position their defensive portfolio with longer duration than previously.

- With High Yield and Sharemarkets continuing to look expensive, whether historically or in the face of weaker economics, they are likely to be volatile as money shifts from the inflation hedge to the economically resilient.

-

As previously mentioned, some markets appear more expensive than others, and the most expensive of them all is the US sharemarket … and

that’s across all traditional valuation measures. The US appears priced for perfection and an economic downturn would certainly be bad.

Recent short bursts of selling have frequently occurred amongst expensive tech stocks as market participants appear nervous about the

sustainability of their earnings trajectory.

- Diversification continues to be essential in this environment, whether shares, bonds, real assets, at both the security and broader asset class level.

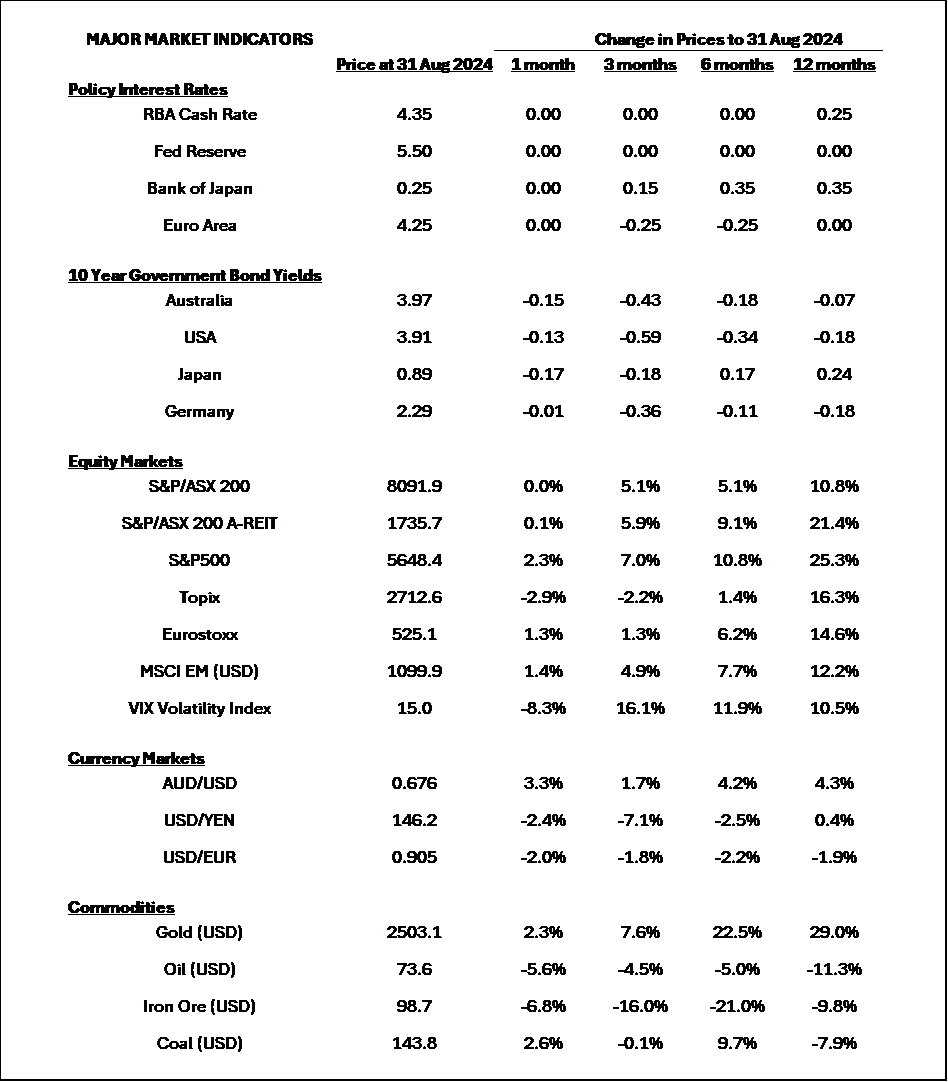

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

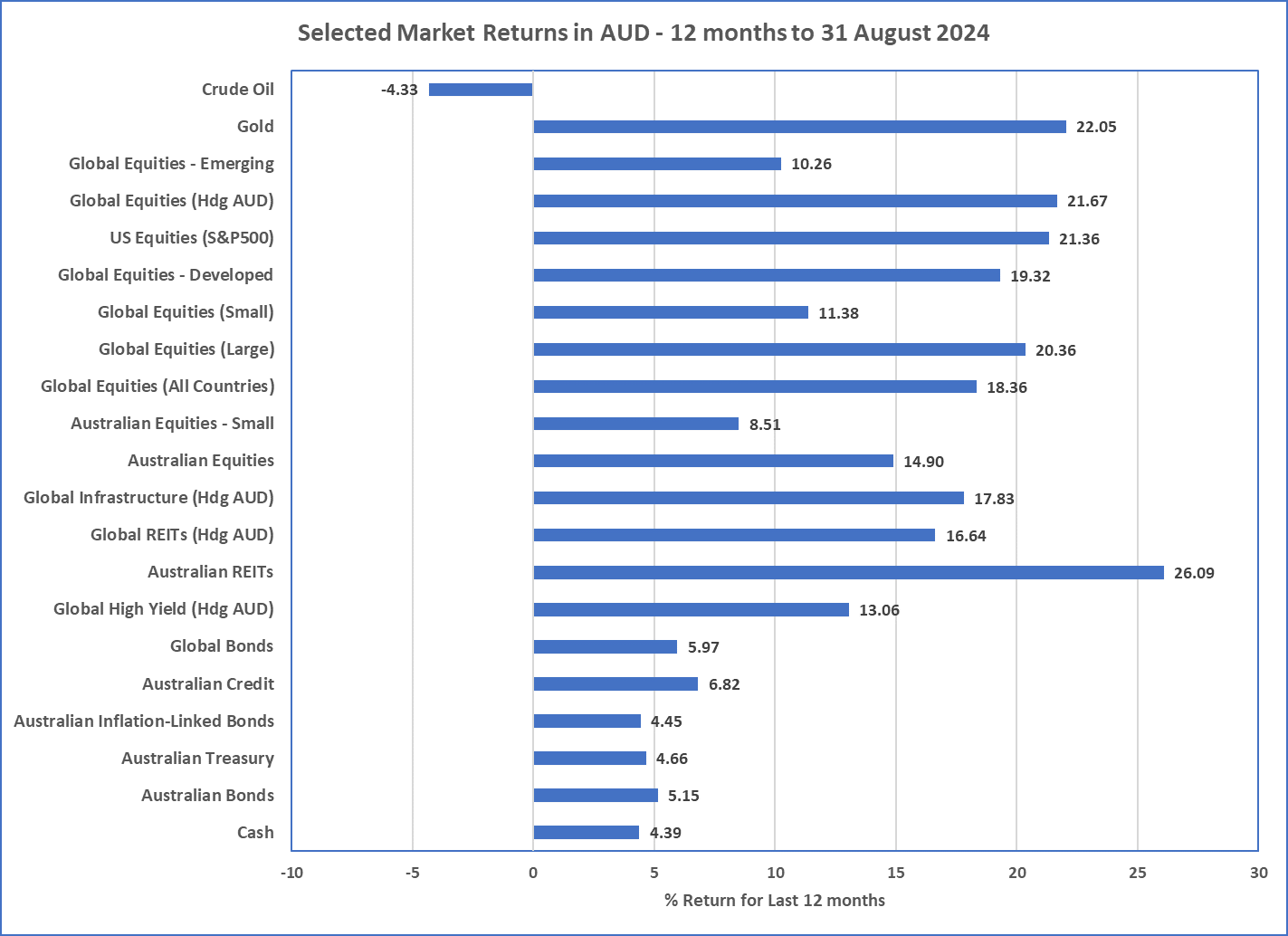

12 month Asset Class Returns

Source: Morningstar

Australian REITs with the best performance over 12 months to 31 August (led by Goodman Group which returned over 70%!!!).

MSCI World Growth and Quality trade around 30 times whilst Value and Small Cap have valuations almost half that.

MSCI World Quality is at its most expensive for many, many years.

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710 600 | AFSL 560040