In summary

Happy investors everywhere

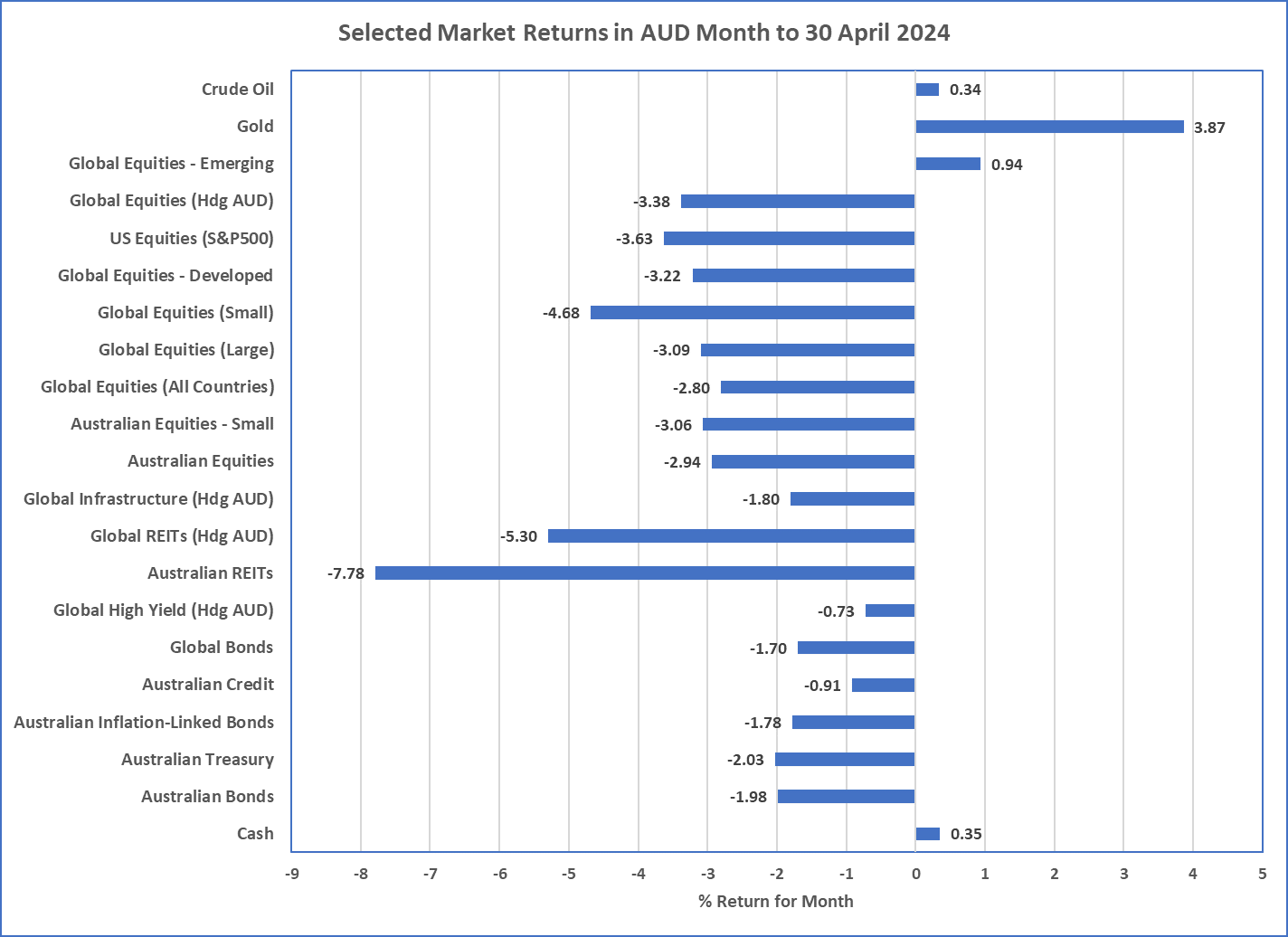

- Almost all asset classes declined in value over April, with the shining star amongst sharemarkets being Emerging Markets, which were up a little under 1%.

- The primary catalyst for this reversal was the higher inflation data in the USA thanks to high services inflation and high energy prices which were influenced by the conflicts in the Middle East.

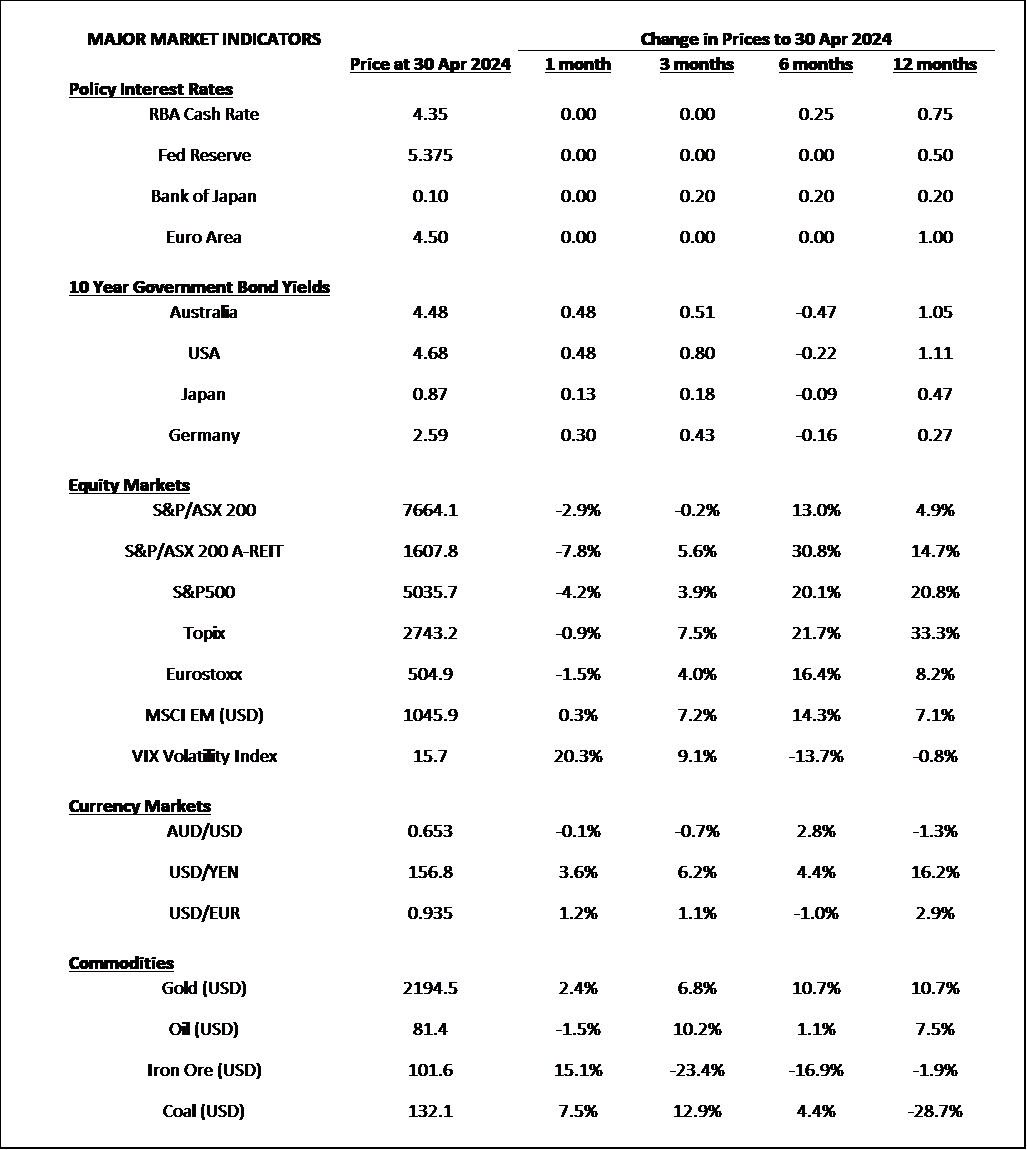

- With higher inflation, any prospects of lower interest rates in 2024 have almost disappeared and this was also reflected in bond markets where yields increased (therefore prices declined).

- In the USA and Europe, bond market yield curves continue to be negatively sloping suggesting economic weakness and now USA has joined the slower economic growth club amongst the larger economies of the world. For the March quarter it produced only 1.6% Real GDP growth. Despite this weak number, unemployment remains low at 3.9%, as does Australia’s at 3.8%.

- From an investment perspective, this small sharemarket reversal is somewhat overdue and our message remains the same … valuation is key to producing superior long term returns and the US sharemarket continues to be expensive and its negative yielding bond market continues as a weaker economy signal so chasing their previous strong returns is unwise.

- It is also worth noting that this small market reversal has not yet provided outstanding opportunities. Emerging Markets and Global Small Companies continue to appear good value, but they still come with significant risks. As a result, portfolio preferences continue to be towards diversification across asset classes and securities.

Chart 1: Time for a break.... or small reversal

Source: Morningstar

Source: Morningstar

What happened last month?

Markets & Economy

-

Sharemarkets around the world decided to pull back a little after an incredibly strong run that started at the end of October 2023.

- Catalysts for the pullback are significant including higher than expected US inflation meaning central bank cash rates will not be declining any time soon. They may, in fact, increase. This is also reflected in higher bond yields which heavily influence lower sharemarket valuations … hence a decline in sharemarkets makes sense.

- So, inflation remains the focus and is not helped by Oil prices rising to be over $80USD per barrel, and services inflation staying high. In the USA services inflation is around 5.3% and in Australia, 4.3% … both figures are well above headline inflation figures, not to mention central bank targets.

- Unemployment has stayed relatively low around the world, (3.9% in USA, 3.8% in Australia, and 2.6% in Japan), but economic growth has slowed. The latest quarterly results show USA, China, and India’s GDP Growth to be 1.6%, 1.6%, and 2.1%, respectively, and these are the strongest growing large economies of the world. Australia’s results are not available until the start of June, but few economists are expecting strong results but more like slightly positive.

- Rising bond yields punished real assets, and the worst performing asset class over April was Australian REITs which were down almost 8%. Over the previous 6 months Australian REITs was the best performing asset class and this was largely due to the market expecting lower interest rates … this asset class is currently behaving like a leveraged bond, so interest rate expectations are currently all that matters for property prices.

- Despite the weak sharemarkets and higher bond yields, High Yield bonds only declined a little in April and they continue to show little return premium for their risk.

Outlook

Maintain diversification

- The weaker economy in 2024 (to 2023) appears to be playing out as expected. The Magnificent 7 (Apple, Microsoft, Amazon, Google, Facebook, NVIDIA, and Tesla) momentum appears to be slowing and breaking up. Whether this is any type of regime change is too early to tell, and markets are only back to their position at the start of March.

- Otherwise, the forward expectations are for more volatility as uncertainty about inflation, and economic growth continues. The risks around stagflation appear to be increasing and geopolitical risks around the Middle East also appear to be increasing. This doesn’t mean to change any long-term investment strategy but it is important to ensure portfolios are well diversified in order to avoid/reduce concentrated risks or risks of the unknown.

- For now, the central bank focus remains inflation and concerns about economic growth are secondary so the Reserve Bank will likely keep rates on hold for the remainder of the year or increase rates if there are any sign of higher inflation.

- As mentioned, High Yield corporate debt does not appear to provide sufficient return for the risk, and we believe there are better places to achieve higher risk-adjusted returns, so for now our fixed interest preference remains investment grade debt.

- With Cash rates yielding higher than bonds, cash continues to be appeal and remains as the fixed interest king.

- Investing with styles that favour value, quality (whether bonds or equities) also appears appropriate but no matter the preferred market, portfolio diversification is crucial.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning Pty Ltd is a Corporate Authorised Representative of MCS Financial Planning Pty Ltd | ABN 11 677 710 600 | AFSL 560040