Market Snapshot: April 2023

In summary

High returning sharemarkets leading into potential recession are unusual

- The global economy continues to experience high inflation and low unemployment across major markets (including Australia) but slowing economic growth that is forecast to be much worse. Central Banks have shown they will increase rates to combat inflation at the cost of short-term economic pain and the bond market continues to point to recession, possibly later in 2023 in USA.

- All asset classes produced positive returns in April, and appeared to barely shrug at the 2023 banking crisis that started in March. Returns in 2023 for Large US Tech Companies have been massive (>>20%) and add to valuation concerns of the USA sharemarket … particularly in the face of forecast weakening economy and continued higher rates.

-

Looking ahead, nothing has changed our primary thesis. Our market expectations demand caution on equity markets as valuations do not reflect

recession possibilities. The current US banking crisis is likely to reduce credit supply, so we expect more investment market volatility

across all asset classes as the global economy slows during 2023.

- From a valuation perspective, we prefer to be underweight in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

- High quality securities (defined by good profitability and strong balance sheets) may provide some recession protection ... which supports some (but not all) US Tech

- Last month we have shifted to a preference for shorter duration in debt markets as bond yields reduce to well below cash interest rates but, unlike recent times, still believe Bonds will provide protection to equity market volatility in 2023.

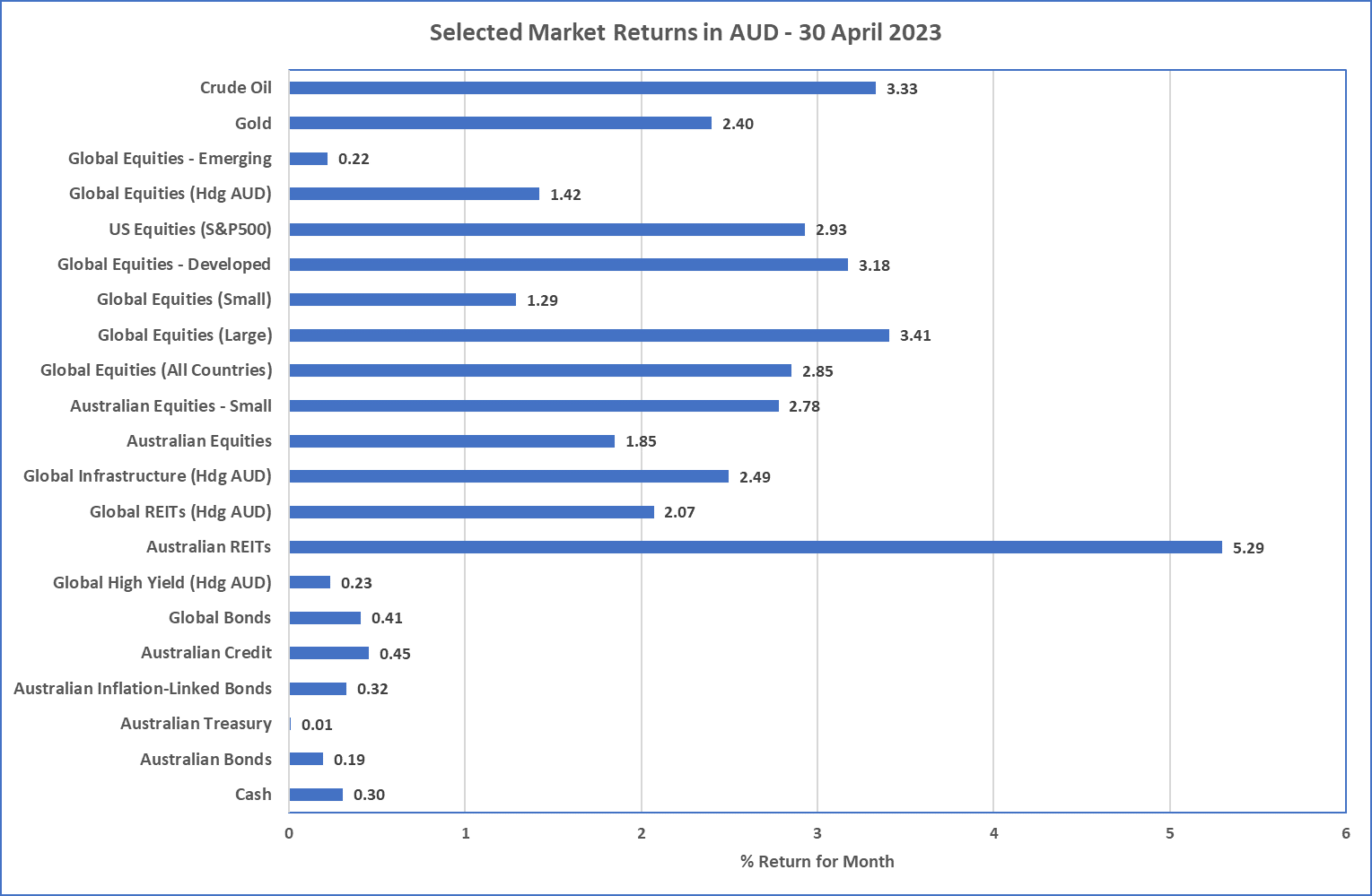

Chart 1: A good month for all

Sources: Morningstar

What happened last month?

Markets & Economy

US Tech Companies outperforming

- The 2023 exuberance for all risky assets continued in April as cash rates largely stayed on hold in Australia and amongst the major economies. Although we now know that changed over the first week of May as the Australian Reserve Bank, European Central Bank, and Federal Reserve all increased by 25bps as the battle to tame inflation continues.

- The big performer during April was Australian REITs, which have had a challenging last 3 months, as higher inflation and higher interest rates do not usually help this economically sensitive asset class.

- The first four months of 2023 was dominated by large US tech companies. Seven of the top ten companies in the S&P500 are tech companies and each produced more than 20% returns this year including Apple (+30.8%), Microsoft (+28.4%), Amazon (+25.5%), Alphabet (+21.7%), Tesla (+33%), and incredible returns from Nvidia (+89.9%), and Meta (+99.7%). These enormous prices rises cannot continue and now present as major risks of the market.

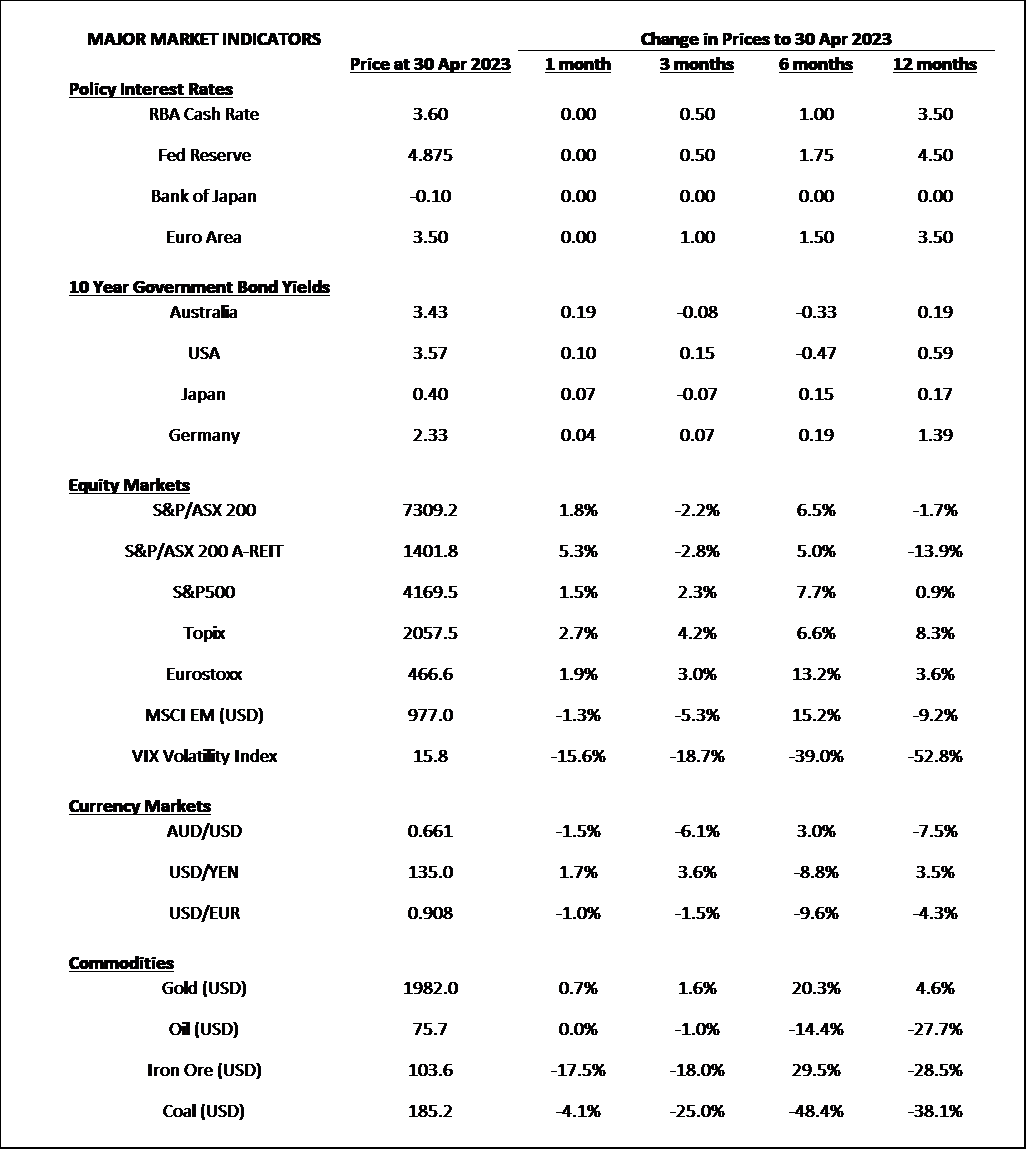

- On the defensive side of portfolios, longer term interest rates increased somewhat with US and Australian 10-year bond yields increasing 0.10% and 0.19% respectively, keeping bond returns somewhat subdues but still positive. This was a small bounce following the collapse and ongoing pressure amongst the banking system in USA and Europe.

- Amongst economic data, inflation continues to be historically high. Australia’s inflation has dropped a little to be 7%, USA is now at 5%, whilst Germany and UK are uncomfortably high at 7.2% and 10.1%, respectively. All are significantly above inflation targets and combined with low unemployment levels (USA 3.4%, Australia 3.5%, UK 3.8%), will keep upward pressure on interest rates.

Outlook

Continued sharemarket caution

- All signals point to weak or volatile sharemarkets. Inflation continues at high levels, bond yield curves signal recession, interest rates continue to rise, and the small/medium banking system in USA is struggling and must rebuild their balance sheets. But sharemarkets are strong with massive returns from the tech sector once again. This points us to caution, diversification, and extreme focus to avoid the disease of FOMO (fear of missing out).

- As alluded to above, valuations risks are greatest in US Equities (particularly tech) and this is our preferred underweight equities market. That said, any volatility in US Tech may still result in volatility for other parts of the market so conservative equity strategies (e.g. low volatility) are preferred.

- Long term bond markets have settled and are yielding below cash rates so our current preference is for shorter than market duration as upward pressure on Cash rates continues. As recession risks increase further longer-term bonds usually tend to perform well so it is still important to hold this diversifying asset class.

- As stated in previous monthly statements, it is essential for all portfolios to diversify across asset classes and securities with a focus on the long term. It’s been a strong 2023 for investment returns but current valuations suggest this is highly unlikely to continue.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

McConachie Stedman Financial Planning is an Authorised Representative of Wealth Management Matters Pty Ltd ABN 34 612 767 807 | AFSL 491619