Market Snapshot: October 2024

Nov 13 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for October 2024.

Stop resting on your (high income earner) laurels

Nov 12 2024Achieving a high income is a significant accomplishment. But don’t be mistaken; a high income does not automatically equate to financial security.

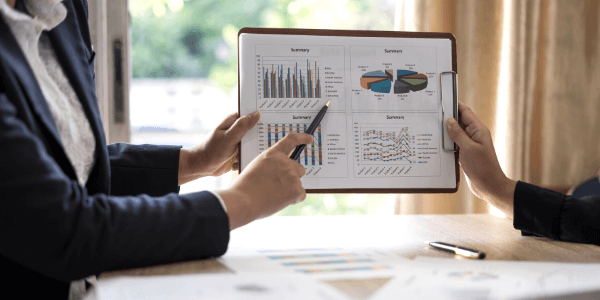

Quarterly Economic Update: July - September 2024

Oct 22 2024Wondering how the Australian economy fared last quarter? With steady GDP growth, inflation pressures, and changing household spending, our latest update covers the key trends you need to know.

Inflation vs Your Savings: The Ultimate Showdown

Oct 22 2024Let’s dive into the showdown between inflation and your savings, and explore strategies to fight back.

Market Snapshot: August 2024

Sep 24 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for August 2024.

Market Snapshot: July 2024

Aug 20 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for July 2024.

We’re heading to St George!

Aug 8 2024Our Tax Director, Myles Smith will be travelling to St George and across the Balonne Shire from Monday the 26th of August to help you with your taxation and accounting queries.

Showcasing Our New Toowoomba Office

Jul 30 2024We recently celebrated the official opening of our newly renovated office located in the heart of the Toowoomba City.

Market Snapshot: June 2024

Jul 17 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for June 2024.

Ease your tax season stress

Jul 15 2024It’s the same time every year but it seems that no matter how prepared investors are for June 30, when it comes to gathering up the necessary documentation to complete tax returns, this exercise creates more stress than it should.

Market Snapshot: May 2024

Jun 27 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for May 2024.

How to Ensure Your Savings Benefit Your Loved Ones

May 9 2024Most of us work hard to save for our retirement, and thanks to tax concessions and compulsory contributions, superannuation often forms a large part of retirement savings.

The rules governing gifts from SMSFs

May 9 2024There are now over 606,000 Self Managed Superannuation Funds (SMSFs) in Australia where the members of the fund are also the trustees.

Market Snapshot: April 2024

May 9 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for April 2024.

ACNC announces targets

Apr 22 2024The Australian Charities and Not-for-profits Commission has announced that it will focus on the misuse of complex corporate structures and the way charities manage cyber-security challenges.

Market Snapshot: March 2024

Apr 15 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for March 2024.

What happens when you can’t manage your SMSF?

Apr 4 2024What do trustees and members of SMSFs do if or when they become incapable of managing their own fund?

McConachie Stedman moves to a new home at 160 Hume Street, Toowoomba

Mar 27 2024After 20 years of business operations at 619 Ruthven Street, Toowoomba, we have relocated to our new premises located at 160 Hume Street, Toowoomba.

Market Snapshot: February 2024

Mar 13 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for February 2024.

.jpg)

Toowoomba Office Relocation

Mar 6 2024We are excited to let you know that the renovations at our new Toowoomba office located at 160 Hume Street have been completed and over the coming weeks, we will be progressively moving across to the new office.

Proposal to increase the value of a penalty unit

Feb 20 2024The Government has proposed to increase the value of a penalty unit which is just another reason to consider a corporate trustee for your SMSF.

Market Snapshot: January 2024

Feb 13 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for January 2024.

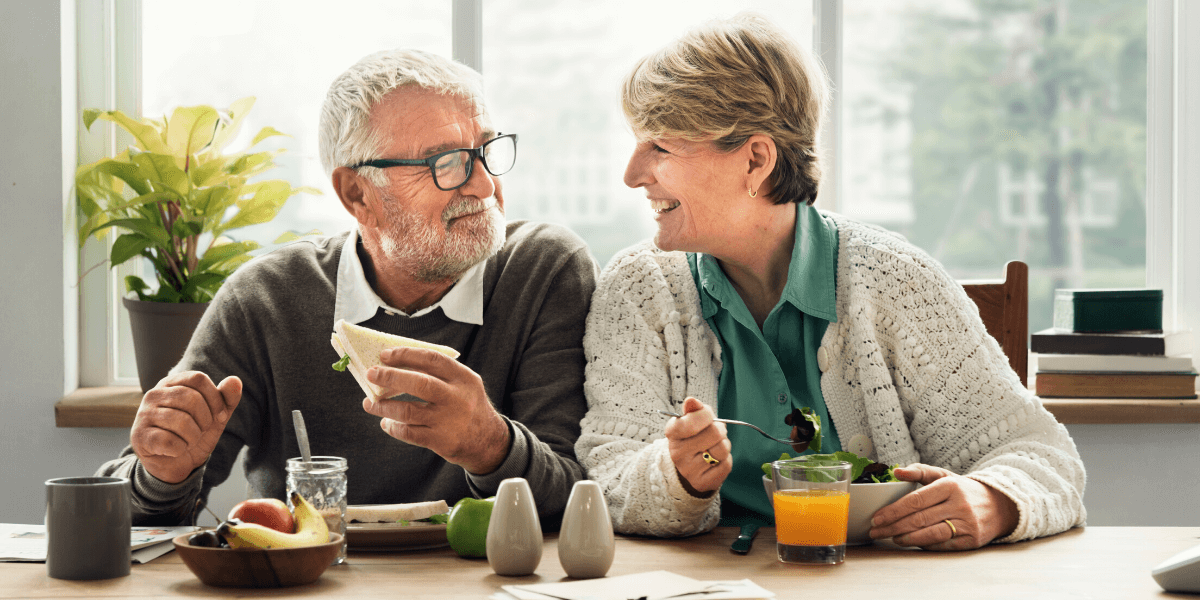

Can you afford to retire early?

Feb 13 2024Many Australians caught in the nine-to-five grind of working for a living dream of the possibility of taking early retirement, spending their days travelling or playing golf or doing nothing much at all.

5 tips for starting your own successful business

Feb 6 2024Many people have great business ideas but are often overwhelmed when they look to turn their idea into a thriving business. Here are 5 tips for translating your dream into reality.

A Self-Employed Superannuation Guide

Jan 22 2024Often, self-employed people prefer reinvesting back into their businesses, hesitant to stash money away in superannuation. Yet, there's a compelling case for setting aside a slice of your earnings.

Market Snapshot: December 2023

Jan 15 2024In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for December 2023.

Five Tips to Improve your Financial Wellbeing

Jan 15 2024In these ever-changing and uncertain times in society, there has never been a greater emphasis on our health and wellbeing.

Market Snapshot: November 2023

Dec 14 2023In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for November 2023.

How much should I have in my emergency fund?

Dec 14 2023It’s the most common story financial professionals hear. Unfortunately, too many people fail to set aside emergency savings to see them through life’s hiccups.

Record-keeping checklist

Nov 15 2023The ACNC has released a record-keeping checklist to promote good record-keeping practice and to support charities in meeting their ACNC obligations.

Charities must disclose their related-party dealings

Nov 15 2023New questions in the recently launched 2023 AIS require charities to disclose their dealings with related parties.

ACNC releases AIS findings

Nov 15 2023The ACNC has released findings from 250 annual information and financial statements submitted for the 2021 reporting period.

Market Snapshot: October 2023

Nov 14 2023In this month’s market snapshot, we take a glimpse at what the market has been up to and what the key developments were for October 2023.

Superannuation - It's not a case of set and forget

Nov 14 2023The government regularly reminds us that each Australian must take responsibility for funding their future.

Roadmap to retiring young

Nov 14 2023The dream of retiring young is one that captivates many peoples’ imaginations. The freedom to live life on your own terms, doing what you want, when you want is undeniably appealing, but is it attainable?

Market Snapshot: September 2023

Oct 9 2023In this month’s market snapshot, we take a glimpse at what the market has been up to and what the key developments were for September 2023.

Achieving Financial Freedom

Oct 9 2023We all have different desires and goals in life, but most of us share the dream that one day we would like to achieve our particular version of ‘financial freedom’.

Don't wait until your 60's to see a Financial Adviser

Oct 9 2023Ask most 30 year olds who their financial planner is and the typical response might be ‘huh?’ After all, financial advisers are for older people with plenty of money to invest, aren’t they?

GST Misunderstandings

Sep 12 2023This article looks at some of the common traps small business operators can fall into when calculating and preparing their BAS returns.

Market Snapshot: August 2023

Sep 10 2023In this month’s market snapshot, we take a glimpse at what the market has been up to and what the key developments were for August 2023.

The Pillars of Retirement Income

Sep 10 2023While older Australians are reportedly among the wealthiest retirees in the world, much of their wealth is tied up in their family home, leaving many to worry about how they will find the money to pay for their day-to-day expenses when they stop work.

Estate Planning is not just for retirement

Aug 22 2023Many people think that Estate Planning is only for people who are close to retirement, especially if we fall into the trap of thinking that Estate Planning is just about getting a will. But did you know that Estate Planning addresses key protection strategies whilst you’re still alive?

Unlocking the potential of Aged Pension and Superannuation benefits

Aug 22 2023The Australian Aged Pension scheme provides a wonderful safety net for those with limited assets in retirement, although many remain confused by how their age pension entitlements differ from so called superannuation income streams.

Market Snapshot: July 2023

Aug 22 2023In this months market snapshot, we take a glimpse at what the market has been up to and what the key developments were for July 2023.

Reporting related-party transactions

Aug 17 2023In 2023 annual information statements, all but basic religious charities will be required to report their related-party transactions to the ACNC due to changes announced in November 2021.

Adhering to ACNC's governance standards

Aug 17 2023The ACNC's governance standards is a set of core principles dealing with how a charity should be run. It's timely to review your compliance with them.

Six Steps to a Happy New Financial Year

Jul 7 2023The new financial year provides an opportunity for a fresh start for your finances. Make this the financial year you get on top of yours… for good!

Market Snapshot: June 2023

Jul 6 2023In this months market snapshot, we take a glimpse at what the market has been up to and what the key developments were for June 2023.

Total Super Balance and Transfer Balance Cap Indexation

Jun 19 2023Along with increasing term deposit and savings interest rates, one of the few benefits of the recent rise in inflation is that some important superannuation thresholds are increasing from 1 July 2023.

Planning for your future retirement

Jun 16 2023Millennials in Australia are facing an unprecedented challenge when it comes to planning for retirement.

Market Snapshot: May 2023

Jun 15 2023In this months market snapshot, we take a glimpse at what the market has been up to and what the key developments were for May 2023.

Four Time-Tested Investment Strategies for Young Investors

Jun 13 2023Young investors have greater access to education around investing, more diverse opportunities for investing, as well as a rise in social media content creators creating communities around building wealth – making this topic much more popular among younger generations.

ATO Focus Areas for 2023 Tax Year

Jun 13 2023The Australian Taxation Office (ATO) has announced its top key focus areas for the tax year, basing the list on the priority areas they often see mistakes being made.

How to plan for the longest “holiday” of your life

May 18 2023Budgeting for retirement is like preparing your suitcase for an epic journey! Packing the right items and planning ahead is essential to ensure you don't run into any unexpected surprises along the way.

Minimum pension limits set to revert to normal levels

May 17 2023In response to the COVID-19 pandemic and the subsequent impact on global economies and financial markets, the Government reduced the minimum pension drawdown rate for account based and transition to retirement pensions by 50% for the 2019/2020 and 2020/2021 financial years.

Manage your cyber risks

May 15 2023With reports of cyber crime on the rise, the ACNC is reminding charities of cyber-security risks, giving guidance and practical tools to help to reduce them.

New guide arms charities to combat fraud

May 15 2023To arm charities to combat fraud, Chartered Accountants Australia and New Zealand in collaboration with Social Business Consulting have released Charity Fraud: Tools for Prevention.

Top tips for charity directors

May 15 2023One of the best ways to bolster transparency and accountability in the sector, says acting commissioner of the Australian Charities and Not-for-profits Commission Deborah Jenkins, is through education.

Market Snapshot: April 2023

May 14 2023In this months market snapshot, we take a glimpse at what the market has been up to and what the key developments were for April 2023.

Market Snapshot: March 2023

Apr 12 2023In this months market snapshot, we take a glimpse at what the market has been up to and what the key developments were for March 2023.

Business Name Scam

Apr 3 2023Not all scams come from far off distant places, and they aren’t all trying to empty your account as quickly as possible.

Why millennials should be mapping their retirement today

Mar 28 2023While millennials have for decades been treated like ‘the children of Neverland, who never grew up’, reality is fast catching up with this

generation, who are now young adults between the ages of 24 and 40.

How to create a debt repayment plan

Mar 28 2023Debt can be overwhelming and stressful, but creating a plan to pay it off can help ease that burden.

The Commonwealth Seniors Health Card

Mar 22 2023In late 2022, the government announced some fairly significant changes to the income test threshold for the Commonwealth Seniors Health Care Card.

Protect your bank account from scammers

Mar 20 2023According to research by the Commonwealth Bank (CBA) (September 2022), 60% of Australians reported having personally been a victim of a scam, or knew someone who had, and 57% of Australians reported becoming more concerned about scams over the last 12 months.

Market Snapshot: February 2023

Mar 10 2023In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for February 2023.

Superannuation for the suddenly single

Mar 9 2023Found yourself separated and suddenly single later in life? There are steps you can take now to boost your super and ensure your divorce doesn’t derail your financial future.

Changes to working from home deductions

Feb 20 2023Following the recent announcement by the ATO, employees who claim the fixed rate work from home method are being advised to keep strict records of their hours.

Your ACNC obligations in a nutshell

Feb 16 2023Charities must meet ACNC obligations to remain registered.

Prepare to self-review tax exemption

Feb 16 2023From 1 July, NFPs that self-assess income-tax exemption and have an active Australian business number will be required to lodge an annual self-review return.

Better data-breach responses needed

Feb 16 2023The big impact on millions of Australians of recent data breaches and the findings of the Notifiable Data Breaches Report: January to June 2022 stresses a need for organisations to have robust information-handling practices and an up-to-date data-breach response plan.

Market Snapshot: January 2023

Feb 14 2023In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for January 2023.

SMSF - The Next Gen

Feb 13 2023While self-managed super funds have long been the preserve of older Australians with time on their hands and large superannuation balances, new data suggests that younger Australians are increasingly choosing to take direct control of their superannuation savings.

Should I pay down my mortgage or invest?

Feb 10 2023It's always a good idea to regularly check in on your financial position, whether there's been a significant change in your financial situation or not. And for those who find themselves with spare funds, it often raises the question, "Should I pay down my home loan or invest these funds elsewhere?".

Don’t Fear a Recession

Jan 13 2023What exactly is a recession and is it all bad news for local share market investors?

What drives young investors to property?

Jan 13 2023Recent research has shown that millennials consider property investment the most appealing investment option, followed by the stock market.

Market Snapshot: December 2022

Jan 12 2023In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for December 2022.

Market Snapshot: November 2022

Dec 13 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for November 2022.

Don’t bank your retirement on your business

Dec 13 2022Many business owners make the mistake of ignoring superannuation in preference for re-investing spare funds in their business, hoping they can then sell at a premium when it comes time to retire.

Changes to Downsizer Contributions

Dec 13 2022One of the more popular changes to the superannuation laws in recent years has been the ability to make downsizer contributions.

Market Snapshot: October 2022

Nov 9 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for October 2022.

Should you downsize to upsize your retirement

Nov 9 2022To downsize or not to downsize is the question facing many home-owning Australians in the lead up to or in their retirement years.

How interest rate changes affect your mortgage

Nov 9 2022Buying a home is one of the most significant decisions a person makes. In a modern landscape where the ratio of homeowners to renters decreases, the emphasis on making an informed financial decision like buying a home is amplified.

Reminder | Director Identification Number

Oct 31 2022If you are a Company Director and you haven’t yet applied for a director ID, your deadline to apply is 30 November 2022.

Market Snapshot: September 2022

Oct 14 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for September 2022.

Why the share market is not the same as the economy

Oct 14 2022At the beginning of 2022 the Australian economy appeared to be sliding into recession, dragged down by higher interest rates and even higher inflation levels.

Queensland association amendments proposed

Oct 13 2022The Queensland Department of Justice and Attorney-General has proposed amendments to the Associations Incorporation Regulation 1999 and the Collections Regulation 2008.

Queensland cuts charities red tape

Oct 13 2022ACNC-registered charities that conduct fundraising in Queensland are from now on required to report information about their fundraising activities only in their annual information statements.

NFPs and commerce

Oct 12 2022Given the changing landscape and difficulty many NFPs have in securing regular funding and donations, the ATO is seeing more of them undertake commercial activities to generate income.

NFP Directors need IDs

Oct 12 2022The ATO has reminded Directors of NFP organisations and clubs registered with the Australian Securities & Investments Commission to get IDs.

ACNC urges charities to consult website

Oct 12 2022The Australian Charities and Not-for-profits Commission is urging charities to consult its website for practical guidance and tips to simplify the filing of annual information statements.

Market Snapshot: August 2022

Sep 14 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for August 2022.

Six retirement wrongs that could send you broke

Sep 14 2022While retirement should be the best years of your life, many Australians make simple, avoidable mistakes with their finances that can leave them dependent on the age pension and without the funds to really enjoy life.

Property investing and SMSFs – The differences

Sep 14 2022Australians love to invest in property. And what’s not to love? It’s tangible, offers diversification and tax benefits, and can provide you with a good income and strong capital growth.

Market Snapshot: July 2022

Aug 16 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for July 2022.

Changes to the Work Test – What do they mean for you?

Aug 16 2022Making superannuation contributions is historically connected to employment. Broadly speaking, it represents savings by employees and the self-employed for their eventual retirement from work.

Six Steps to a Successful Debt Master Plan

Aug 16 2022With Australian households being one of the most indebted in the world, this article explains six key steps to quickly get your cash flow back in the black.

A History of Home Loans

Aug 16 2022This article looks at the history of home loans from the 1970’s to 2022, detailing the rise of inflation and consequent interest rate spikes.

Director Penalty Notices

Aug 5 2022The ATO can make company directors personally liable for unpaid GST, PAYG and superannuation.

Changes for Qld incorporated associations

Jul 27 2022Law changes are being introduced to reduce red tape and improve internal governance for Queensland’s 23,300 incorporated associations, including 3750 registered as charities.

ASIC highlights key reporting areas

Jul 27 2022The Australian Securities & Investments Commission is urging directors, report preparers, and auditors to assess whether financial reports provide useful and meaningful information.

SD replaces RDR

Jul 27 2022The Australian Accounting Standards Board has developed a new simplified-disclosure standard to replace reduced-disclosure requirements.

Charities under the microscope

Jul 27 2022The ACNC has reviewed registered charities to ensure that their records are accurate and only eligible charities are listed.

Charity-sector insights

Jul 27 2022The latest Australian Charities Report details Australian charities’ contribution to the economy and communities.

Adhering to governance standards

Jul 27 2022The Australian Charities and Not-for-profits Commission governance standards is a set of core principles dealing with how a charity should be run. Charities must meet the standards to be registered and remain registered with the ACNC.

Market Snapshot: June 2022

Jul 7 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for June 2022.

The Female Investor

Jul 7 2022According to an ASX Australian Investor Study completed in 2020, women make up 42% of Australian investors.

Interest Rates 101

Jul 6 2022While we understand banks charge interest on their home loans, exactly what determines the rate?

Market Snapshot: May 2022

Jun 13 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for May 2022.

Take control of your mortgage

Jun 13 2022For most Australians the largest financial commitment ever undertaken is their home mortgage.

Superannuation Contribution Changes: 1 July 2022

Jun 13 2022Several key super changes which may impact your ability to contribute to your SMSF, are set to take effect from 1 July 2022.

Market Snapshot: April 2022

May 9 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for April 2022.

Withdrawal and Recontribution Strategy

May 9 2022A common strategy to reduce potential tax in the event your super is paid as a death benefit is a withdrawal and recontribution strategy.

Unlocking the mysteries of your super statement

May 9 2022Superannuation statements. Boring, right? But if, like many people, you toss your annual super statement in a drawer or hit delete, you could be depriving yourself of many thousands of dollars just when you need it.

Charity thresholds change

May 6 2022Thresholds for determining a charity’s size are changing, and thousands of charities will see their reporting obligations reduced.

New rules for meetings and documents give flexibility

May 6 2022Thousands of Australia’s registered charities will enjoy greater flexibility when staging meetings – as well as signing and executing documents – through recent amendments to federal legislation.

The effect of rising inflation

May 6 2022The word ‘inflation’ doesn’t only dominate business news headlines, but finds its way into general news reports too. So, what is inflation and how does it affect you?

Nine Tried and True Money Tips

May 6 2022Life gets so busy and the months soon roll into years when suddenly you find that your finances are off track and you’re nowhere near achieving your goals.

Market Snapshot: March 2022

Apr 19 2022We take a glimpse at what the market has been up to and what the key developments were for March 2022.

How to create savings while paying off debt

Apr 19 2022Over the past 30 years, Australians' household debt has increased. According to the Reserve Bank of Australia, our household debt-to-income ratio has risen from 70 per cent in the early 1990s to around 190 per cent today.

Frequently asked questions about super

Apr 19 2022If the ins and outs of superannuation leave you confused, the answers to these frequently asked questions will help you understand the

basics.

Is your business .au ready?

Apr 6 2022Anyone with a local connection to Australia including businesses, associations and individuals is now able to register a new category of domain name.

Federal Budget 2022 - 2023 Analysis

Mar 30 2022Last night, Treasurer Josh Frydenberg delivered the final Federal Budget before the next election. So what does the 2022-23 Budget announcement mean for you, your family and your community?

Understanding Self-Managed Superannuation Fund Performance

Mar 11 2022New research released by the University of Adelaide provides tangible evidence of the benefits of investment diversification.

Should you invest your house deposit?

Mar 11 2022With property prices high and interest rates low, many potential homebuyers are struggling to save a large enough house deposit. With the use of a case study, this article discusses the pros and cons of investing your savings if you are a few years out from buying a home.

Market Snapshot: February 2022

Mar 11 2022We take a glimpse at what the market has been up to and what the key developments were for February 2022.

The ‘what, why and how’ of contributing to super

Feb 15 2022Despite frequent changes to its governing rules, superannuation remains, for most people, a tax-effective environment in which to save for retirement.

Managing CGT in a Self-Managed Super Fund

Feb 15 2022When you dispose of an asset and make a capital gain, you may be liable for extra tax. There is no separate tax rate for capital gains. Instead, some or all of the capital gain is added to your assessable income and taxed along with your other income at your marginal tax rate.

Where does the money go when the share market “corrects”?

Feb 15 2022During a share market correction or downturn, the media will report that a certain market has ‘lost’ billions of dollars. But what happens to all that money and where does it go? Is it really lost?

Market Snapshot: January 2022

Feb 15 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for January 2022.

Helping NFPs with best-practice reporting

Jan 13 2022Enhancing Not-for-Profit and Charity Reporting by Chartered Accountants Australia and New Zealand guides not-for-profits and charities in how to prepare top-quality annual, financial, and performance reports.

ACNC urges charities to comply

Jan 13 2022The ACNC urges charity leaders and their accountants to ensure that they comply with amended reporting regulations.

The art of downsizing

Jan 12 2022If it’s time to think about downsizing, there’s more to it than simply selling one house and buying another. Here are a few things to consider.

Working from home? How to boost your next tax return.

Jan 12 2022If you've been working from home, you've likely set up a dedicated work area, and you're using your own electricity and resources to power your workday. But which of these items can you claim in your next tax return to ensure you maximise your return?

Is your inner entrepreneur calling?

Jan 12 2022Work From Home (WFH) arrangements seem to have got our creative juices flowing with more online, home-based businesses springing up every day, providing a limitless variety of goods and services.

The secret to ‘living the dream’

Jan 10 2022We all, to a greater or lesser extent, have an idea of our dream lifestyle. So how, as a nation, are we faring?

The art of dividend reinvestment

Jan 10 2022To help their investors reap the rewards of compounding, many companies offer dividend reinvestment plans (DRPs).

Am I too young to manage my super?

Jan 10 2022Control and flexibility are two reasons why more young people are considering setting up a SMSF, but many are unaware of how they work and what’s involved.

Market Snapshot: December 2021

Jan 10 2022In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for December 2021.

Making Christmas a time of joy for you

Dec 7 2021Some tips and insights to help your readers get ready for the gift-giving and celebrations of Christmas.

Market Snapshot: November 2021

Dec 7 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for November 2021.

Why ‘low-interest’ is causing high interest in property

Dec 7 2021Is it the right time to leap into the property investment market? With low interest rates and rising house prices, many investors are jumping on the property band wagon.

Closing the gender superannuation gap

Dec 7 2021For many women approaching retirement, the gender pay gap has resulted in an uncertain retirement future.

How to identify a scam

Nov 23 2021Naturally, people aspire to get the most out of their investments, especially if a great opportunity is presented by a ‘trusted’ organisation. However, investment scams occur more often than you may think, highlighting the risk both self-directed investors and SMSF trustees may potentially face when seeking new investment opportunities.

Market Snapshot: October 2021

Nov 18 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for October 2021.

Renting in Retirement: Is it Possible?

Nov 18 2021This article compares the average incomes of Australian retirees and analyses how renting may impact their retirement lifestyle.

ATO Data Matching and Analysis

Nov 16 2021It was hard to miss the media splash about international tax evasion when the Pandora Papers were released, with local interest focussing on what Australian tax authorities would do with this massive trove of information.

Varying PAYG instalments due to COVID-19

Nov 15 2021Taxpayers can vary their pay as you go ('PAYG') instalments throughout the year if they think they will pay too much, compared with their estimated tax for the year.

Preparing for the new Director ID regime

Nov 15 2021As part of its Digital Business Plan, the Government announced the full implementation of the 'Modernising Business Registers' program. This included recently enacted legislation introducing the new director identification number ('director ID') regime.

Your SMSF: Wind it up or pass it on?

Oct 13 2021Now that new legislation allows a maximum of six members in an SMSF, some fund trustees may be wondering if this could be an easy way to ensure a smooth transfer of their super to the next generation.

Spotlight on super performance

Oct 13 2021Superannuation has provided most fund members with stellar returns since last year’s COVID lows. As always though, some funds performed better than others and recent government reforms make it easier to find out how your fund compares.

Market Snapshot: September 2021

Oct 13 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for September 2021.

ATO support for employers with expansion of STP

Oct 6 2021As part of the expansion of Single Touch Payroll (known as STP Phase 2), from 1 January 2022, employers will need to report additional payroll information in their STP reports.

GST and the sale of your business property

Oct 6 2021Selling your business property is a big decision and it’s easy to focus on the sale price, but this can be a costly error.

Time running out to register for the JobMaker Hiring Credit

Sep 7 2021The JobMaker Hiring Credit scheme's third claim period is now open, so if a taxpayer has taken on additional eligible employees since 7 October 2020, they may be able to claim JobMaker Hiring Credit payments for their business.

ATO warns property investors about common tax traps

Sep 7 2021The ATO is reminding property investors to beware of common tax traps that can delay refunds or lead to an audit costing taxpayers time and money.

Expansion of support for SMEs to access funding

Sep 7 2021The Government is providing additional support to small and medium sized businesses ('SMEs') by expanding eligibility for the SME Recovery Loan Scheme.

Market Snapshot: August 2021

Sep 7 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for August 2021.

Frankly speaking: Tax benefits of shares

Sep 7 2021Australian shares are popular investments with self-funded retirees and anyone who depends on income from their investments, due in part to the favourable tax treatment of franked dividends.

Don’t take super cover for granted

Sep 7 2021Buying insurance through super has many advantages, but you need to make sure you are getting the right cover for your individual needs. In some cases, you may be paying for nothing.

Aged Care Payment Options

Sep 7 2021When it comes time to investigate residential aged care for yourself, your partner, parent or relative, the search for a facility and how to pay for it can seem daunting.

Market Snapshot: July 2021

Aug 18 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for July 2021.

Investing lessons from the pandemic

Aug 18 2021While every financial crisis is different, some investment rules are timeless. So, what are the lessons of the last 18 months?

What if I exceed my super contribution caps?

Aug 18 2021Making additional personal contributions to superannuation is a great way to boost your retirement savings in a tax-effective way. But there are strict caps or limits on the amount you can contribute each year and stiff tax penalties for exceeding the limits.

New Financial Year rings in some super changes

Jul 15 2021As the new financial year gets underway, there are some big changes to superannuation that could add up to a welcome lift in your retirement savings.

Market Snapshot: June 2021

Jul 15 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for June 2021.

What’s up with inflation?

Jul 13 2021Fears of a resurgence in inflation has been the big topic of conversation among bond and sharemarket commentators lately, which may come as a surprise to many given that our rate of inflation is just 1.1 per cent.

SMSFs closing the age and gender gap

Jul 13 2021Self-managed super funds (SMSFs) have emerged from a difficult year stronger than ever. Not only have balances been repaired after the initial market shock in the early days of COVID-19, but more young people and women are taking control of their retirement savings.

Market Snapshot: May 2021

Jun 16 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for May 2021.

Reduction in minimum pension drawdown

Jun 16 2021The Federal Government recently announced an extension of the temporary reduction in superannuation minimum drawdown rates for a further year to 30 June 2022.

Time to review your income protection cover

Jun 16 2021If you’ve owned an individual income protection or salary continuance policy in recent years, you may have seen your premiums increase as insurers struggled to cover their large losses on these products.

Counting down to June 30

Jun 4 2021As the end of the financial year approaches, now is a good time to check some new and not so new ways to reduce tax and boost your savings.

Tax Alert June 2021

Jun 4 2021Here’s a roundup of some of the key developments when it comes to tax.

Market Snapshot: April 2021

May 20 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for April 2021.

SMSF sector continues to grow

May 20 2021The ATO has recently released its annual statistical overview for self managed superannuation funds (SMSFs) the 2018/2019 financial year, providing key statistics and analysis of the SMSF sector.

Federal Budget 2021-22: Focus on Tax

May 12 2021Support for Australia’s businesses and our personal finances was at the heart of this year’s Federal Budget as the Morrison Government continues its attempts to strengthen the post-lockdown economy.

Federal Budget 2021-22 Analysis

May 12 2021In his third and possibly last Budget before the next federal election, Treasurer Josh Frydenberg is counting on a new wave of spending to ensure Australia’s economic recovery maintains its momentum.

ACNC releases new best-practice disclosures guide

May 11 2021The ACNC has published a new best-practice guide for charities reporting on government revenue they receive.

Making a super split

Apr 15 2021Separation and divorce can be a challenging time, often made all the more difficult when you have to divide your assets. So how do you go about decoupling your superannuation?

Weighing up the costs and benefits of an SMSF

Apr 15 2021For many people, the idea of managing and investing your own retirement savings is very appealing. But there is ongoing debate over whether running your own self-managed super fund (SMSF) is cost effective. So, what are the arguments for and against having your own fund?

Market Snapshot: March 2021

Apr 15 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for March 2021.

Bonds, inflation and your investments

Apr 15 2021The recent sharp rise in bond rates may not be a big topic of conversation around the Sunday barbecue, but it has set pulses racing on financial markets amid talk of inflation and what that might mean for investors.

Stay safe from scams

Apr 13 2021As we approach tax time, we also head into the season where scammers increase their activity – that is, looking to hoodwink small business and individuals alike. Scammers are becoming increasingly sophisticated, so it pays to be aware of what is real and what is fake.

Good records the best defence when the Tax Man knocks

Apr 13 2021As the Australian Taxation Office (ATO) turns its attention to businesses and individuals who have used COVID-related support programs, many taxpayers are likely to find themselves on the tax man’s radar.

Indexation brings changes to superannuation caps from 1 July 2021

Mar 15 2021From 1 July 2021, the concessional and non-concessional caps are scheduled to increase.

There's more than one way to boost your retirement income

Mar 15 2021After spending their working life building retirement savings, many retirees are often reluctant to eat into their “nest egg” too quickly. This is understandable, given that we are living longer than previous generations and may need to pay for aged care and health costs later in life. But this cautious approach also means many retirees are living more frugally than they need to.

Love and Money: Achieving Financial Harmony

Mar 15 2021Given that money has the potential to be a source of conflict in relationships, it’s a now a good time to get in sync to ensure you are on track to achieving financial harmony.

Market Snapshot: February 2021

Mar 15 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for February 2021.

Avoid the rush: Prepare your business for June 30

Mar 15 2021As the economy begins to get back on its feet, it’s time to get your business back on track and start preparing for this year’s tax time.

Give your finances a shake out

Mar 15 2021Like trees losing their leaves in autumn, why not take a leaf out of their book and choose this time of year to shed some of your own financial baggage.

Tax Alert: March 2021

Mar 15 2021Individuals and small business owners who have taken advantage of the government’s COVID-19 support programs will find themselves increasingly under the tax man’s microscope in coming months. This is just one of the key developments occurring in the world of tax at the moment.

Market Snapshot: January 2021

Feb 17 2021In this month's market snapshot, we take a glimpse at what the market has been up to and what the key developments were for January 2021.

Is an SMSF right for you?

Feb 17 2021As anyone who has joined the weekend crowd at Bunnings knows, Australians love DIY. And that same can-do spirit helps explain why 1.1 million Aussies choose to take control of their retirement savings with a self-managed superannuation fund (SMSF).

Turning redundancy into opportunity

Feb 17 2021As the economy starts to recover from COVID-19 shutdowns, some sectors may take longer than others to return to their normal operating capacity and some companies may never fully recover. That means there is still the chance that some employees could be made redundant.

Contractor or employee?

Feb 17 2021With COVID-19 having a significant impact on traditional employment, many people are working as a contractor for the first time either by choice or necessity. It’s not just a lifestyle decision; from the tax and superannuation perspective, there are important differences between being an employee and a contractor.

Mind the Insurance gap

Feb 15 2021At a time when many people have been focused on their family’s health and livelihood, having adequate life insurance has never been more important. Yet the gap between what we need and what we have, has been growing.

ACNC urges charities to prevent fraud and cybercrime

Feb 9 2021The ACNC has urged charities to take steps to prevent fraud and cybercrime.

ACNC urges PBIs to check their details

Feb 9 2021The ACNC is urging charities with deductible-gift-recipient endorsement to check their registration details.

Targeted funding critical for NFPs’ survival

Feb 9 2021The Australian Institute of Company Directors annual NFP Governance and Performance Study reveals that many organisations’ future was under threat even before the challenges of COVID-19.

The right time for estate planning

Feb 9 2021A common misconception about estate planning is that you should only worry about it when you are old. However, estate planning is one of the most important things you can do to protect yourself, your assets and your loved ones.

Lessons from 2020 to secure a bright future

Feb 9 2021It was a year most of us would like to forget. And yet, some of the toughest lessons of 2020 had a silver lining.

Market Snapshot: December 2020

Feb 9 2021We take a glimpse at what the market has been up to and what the key developments were for December 2020.

Retrain your staff with the tax man’s help

Feb 9 2021For many business owners, fear of incurring a Fringe Benefits Tax (FBT) bill has kept them from retraining and re-skilling their employees to perform different roles or activities within the business.

2020 Year in Review

Feb 9 2021Just as we were recovering from the long drought and the worst bushfires on record, the global coronavirus pandemic took hold and changed everything.

Tax Alert December 2020

Dec 11 2020Although individuals and small business owners are now enjoying welcome tax relief in the wake of some valuable tax changes, there is more on the horizon as the government seeks to reboot the Australian economy.

Market Snapshot: November 2020

Dec 8 2020In summary The US election appears resolved despite Trump’s protests and avoidance of administration handover. Whilst this outcome was not unexpected, it didn’t result in the expected increased equity market volatility.

Tis the season for wise spending decisions

Dec 8 2020The traditional festive holiday season is likely to be a little different this year, but one thing is likely to remain the same – the temptation to spend and the post-Christmas budget hangover.

Tax effective ways to boost your super

Dec 8 2020After a year when the average superannuation balance fell slightly or, at best, moved sideways, the summer holidays could be a good opportunity to think about ways to rebuild your savings while being mindful of tax.

Six member SMSFs a step closer

Nov 17 2020Legislation was introduced into the Senate in September 2020 to expand the maximum number of members of a self-managed superannuation fund (SMSF) from 4 to 6. The intention is to allow greater flexibility for SMSFs, particularly for family groups.

Market Snapshot: October 2020

Nov 17 2020In summary The US election appears resolved despite Trump’s protests and avoidance of administration handover. Whilst this outcome was not unexpected, it didn’t result in the expected increased equity market volatility.

Easy ways to boost your credit score

Nov 17 2020Most Australians are only vaguely aware – or completely unaware – of the fact that credit-reporting agencies monitor their financial transactions. While most Australians don’t give much thought to what’s on their credit report, the credit score that’s based on the

Making your savings work harder

Nov 17 2020With tax cuts and stimulus payments on the way, Treasurer Josh Frydenberg is urging us to open our wallets and spend to kick start the national economy. But if your personal balance sheet could do with a kick along, then saving and investing what you can also makes...

Granny flats: Tax tips and traps

Nov 10 2020Adding a granny flat to your property sounds like a great idea. A property to rent out to generate some welcome extra income, or a home for adult children or mum and dad in their later years. But there are important tax and personal considerations to think about...

FBT changes under COVID: What are the rules?

Nov 10 2020The COVID-19 pandemic is raising some interesting questions for small business employers in relation to their Fringe Benefit Tax (FBT) liabilities. With many employees working from home, common employee benefits are often not being supplied, while some employers are...

COVID-governance report released

Oct 21 2020The Australian Institute of Company Directors and the Governance Institute of Australia have released a new report on the impact of COVID-19 on board practices. The report reveals insights into governance challenges in the current climate. Governance through a crisis:...

Court clarifies casual-employment rules

Oct 21 2020The Australian Securities & Investments Commission has issued an FAQ on accounting implications of clarified casual-employment rules. ASIC urged companies to consider whether they should provide for additional employee entitlements (including annual leave,...

DGRs to be registered as charities

Oct 21 2020The Australian Securities & Investments Commission has issued an FAQ on accounting implications of clarified casual-employment rules. ASIC urged companies to consider whether they should provide for additional employee entitlements (including annual leave,...

Market Snapshot: September 2020

Oct 15 2020In summary September saw a break in the rally in global equity markets. Several factors contributed to this, including signs that the global recovery, while proceeding, is nevertheless slowing down. Growing concerns about prospects for fiscal stimulus in the US added...

Managing investment risk in uncertain times

Oct 15 2020This year has exposed investors to the end of a bull market and the start of a global recession, all caused by a totally unexpected global pandemic. The outlook for the global economy and investment markets remains uncertain until an effective vaccine is available....

Life cover: More essential than ever

Oct 15 2020Living through COVID-19 has brought many challenges and shifting priorities as we deal with the financial impacts of the pandemic, and that includes the issue of life insurance. On the one hand, the pandemic has highlighted the importance of life cover. On the other,...

Purchasing property through a SMSF

Oct 15 2020Investing in property is a popular option for self managed superannuation funds (SMSF). Unlike retail funds, the members of an SMSF are the trustees, and make all the investment decisions. This can include investing in residential or commercial property. In deciding...

Federal Budget 2020-21 Analysis

Oct 7 2020Building a bridge to recovery In what has been billed as one of the most important budgets since the Great Depression, and the first since the onset of the COVID-19 pandemic dragged Australia into its first recession in almost 30 years, Treasurer Josh Frydenberg said...

Tax Alert: September 2020

Sep 10 2020Many small business owners and sole traders will be breathing a sigh of relief following the extension of the JobKeeper scheme until March

next year. At the same time, however, the ATO is stepping up its compliance activities. Here’s a roundup of some of the key...

Stress testing your business

Sep 10 20202020 has challenged businesses on a global scale. With restrictions, shutdowns, and a global financial crisis changing many businesses

operating conditions, business owners are struggling to keep up with the increased speed of change that 2020 has brought about. So...

Market Snapshot: August 2020

Sep 8 2020In summary August saw restrictions maintained in a number of countries to contain second waves of Covid-19. Progress was made in Australia and the US in reducing infection rates, but the US still has a long way to go before they really get the virus under control....

Inflation, deflation: What’s in a name?

Sep 8 2020When the inflation rate fell into negative territory in the June quarter, it was so unusual it begged the question of what this means for the economy. Are we facing deflation or even stagflation and what is the difference? In the June quarter the annual inflation...

Is it time to revisit your SMSF strategy?

Sep 8 2020Self-managed super funds (SMSFs) have had a challenging year, with COVID-19 linked market uncertainty affecting income and returns. But SMSF trustees haven’t been sitting on their hands. One of the main reasons people give for wanting to establish an SMSF is to have...

Getting retirement plans back on track

Sep 8 2020After a year when even the best laid plans have been put on hold due to COVID-19, people who were planning to retire soon may be having second thoughts. You may be concerned about a drop in your super balance, work security, or an uncertain investment outlook....

Understanding Capital Gains Tax when you inherit

Aug 17 2020Receiving an inheritance is always welcome, but people often forget the tax man will take a keen interest in their good fortune. There are numerous situations whereby when ownership of an asset is transferred or disposed of it may incur a capital gain or loss with...

Purchasing a property using a self managed superannuation fund (SMSF)

Aug 17 2020Many people like to invest in property. In these uncertain times, investing in listed shares or managed funds can often seem too risky. In contrast and although they have increased recently, the returns from term deposits or other fixed interest securities is relatively low.

Cash is king in a crisis

Aug 17 2020Most of us understand the importance of saving for a rainy day, but sometimes it takes a crisis like the current pandemic to make us act on

it. With so many jobs lost and the outlook unknown, having a cash buffer means you are more able to manage unexpected expenses...

Market Snapshot: July 2020

Aug 17 2020July saw second waves of Covid-19 infections around the world with cases per week in a number of countries, including Australia, the US and Japan, exceeding previous peaks. Some countries have responded by reinstating national restrictions, while others, including...

Make selling your business less taxing

Aug 17 2020Selling a business you have spent so many years building up can be a difficult process, but getting the best price is not the only consideration. Tax has a big role to play in the financial result. That means the ATO will be paying close attention. Selling a business...

Several AASBs operative for 30 June

Jul 29 2020Under AASB 15 Revenue from Contracts with Customers, revenue is recognised so that promised goods and services are transferred in an amount that reflects the consideration to which their provider expects to be entitled. AASB 15 requires the application of a five-step...

COVID-19 causes Leases amendment

Jul 29 2020AASB 16 Leases has been amended to exclude rent holidays caused by COVID-19 from being assessed as lease ‘modifications’. The amendment provides a practical expedient that permits lessees not to assess whether rent concessions such as rent holidays and temporary rent...

COVID-19 and going concern

Jul 29 2020COVID-19 is having an unprecedented impact on the economic outlook for Australian and global economies. For the first time, many entities will be required to consider in more detail their solvency and ability to continue operating as a going concern.

Red tape reduced for Queensland charities

Jul 29 2020Law changes have been introduced to reduce red tape and improve internal governances for the 22,900 incorporated associations in Queensland, including 3750 registered as charities. Associations Incorporation and Other Legislation Amendment Bill 2019 was passed by...

The Housing Market: Shaken not stirred

Jul 14 2020With Australia in a COVID-induced recession, residential property is not immune to falling economic activity. Yet housing prices are proving surprisingly resilient. Only months ago, economists were forecasting a housing price slump of 20 per cent or more. Now, most...

New financial year, new perspective

Jul 14 2020The start of the financial year is always an excellent time to take stock of your current situation and visualise where you’d like to be in the future. It’s fair to say this year hasn’t been ‘business as usual’! While no-one could have predicted the first six months...

Changes to superannuation contribution rules for over 65’s

Jul 13 2020The May 2018 Federal Budget announced a number of changes to the superannuation work test and contributions for over 65s. These changes have recently come into effect and will impact the way many people contribute to their or their partners’ super fund as they near...

Working from home deductions

Jul 13 2020With the financial year ending just over a week ago and people starting to think about completing their tax returns, we thought that we

should spend some time covering home office deductions. For the first time, many clients have been forced to work from home and as...

Family trusts under ATO scrutiny

Jul 13 2020Family trusts have stood the test of time as a means of protecting family and business wealth, and managing the distribution of trust income in a tax-effective way. But the misuse of these tax benefits by a small minority periodically puts trusts in the firing line of...

COVID-19: Adapting for Success

Jun 18 2020As COVID-19 restrictions came into effect in March of this year, changing the way businesses operated across the country, many small businesses adopted out of the box techniques to keep their businesses moving despite the many challenges and roadblocks thrown their...

Timing the economic reboot

Jun 16 2020After successfully navigating our initial response to the COVID-19 (coronavirus) health crisis, backed up with $285 billion in government support to individuals and businesses to keep the economy ticking over, thoughts are turning to how to get the economy back on its...

Market Snapshot: May 2020

Jun 16 2020Equity markets pushed higher in May, taking valuations to very expensive levels, as markets took an almost exclusively optimistic view of declining infection rates, reports of progress towards a vaccine and the benefits of economies re-opening. In addition,...

Could your business do with a cash flow boost?

Jun 3 2020The two cash flow boosts provided by the federal government to help businesses deal with the COVID-19 emergency have largely been overshadowed by the JobKeeper program, but they could provide valuable financial support to organisations that qualify. Some businesses...

How COVID-19 changes tax time

Jun 3 2020As this financial year draws to a close, it will be viewed as a year like no other. COVID-19 (coronavirus) has impacted everybody’s life, albeit in different ways for different people. For some, staying at home has meant you have greater savings; for others, the virus...

Tax Alert: June 2020

Jun 3 2020With COVID-19 dominating everyone’s thoughts, employers are being offered a brief window of opportunity to get their tax affairs in order with the new Superannuation Guarantee (SG) amnesty. There is also a range of virus related assistance on offer to help affected...

Keeping the economy moving

May 20 2020The Morrison Government’s mind-bogglingly large support packages to get Australians through the COVID-19 shutdown have dominated headlines,

and rightly so. Only months ago, the Australian economy was in relatively good shape and headed for a Budget surplus. Behind the...

EOFY Key Tax Dates

May 20 2020If you have been out of routine this year, you have probably realised how easy it is to lose track of the days. To help keep you up to date, we have put together a list of dates you will not want to forget. The end of financial year in Australia is looking a little...

Market Snapshot: April 2020

May 13 2020In summary Markets embraced a risk-on mood in April with a strong rally in equities as investors welcomed declining virus infections and reports of possible medical treatments. Support from governments and central banks also helped. However, as the month went on, the...

Queensland Government land tax concessions

May 13 2020In order to ameliorate some of the economic impact of the coronavirus on landlords and property owners, the Queensland Government has provided some land tax concessions, which apply in the 2019/2020 and 2020/2021 financial years. The concessions are: A rebate of 25%...

Is your Super fund balanced?

May 13 2020The recent sell-off on global sharemarkets due to the economic impact of COVID-19 has highlighted the risks of depending too heavily on a single asset class. Even before the current crisis, the ATO was concerned about a minority of self-managed superannuation funds...

Time to reassess your financial priorities

May 13 2020At a time of uncertainty about the economy, not to mention unexpected social isolation, people are rethinking their personal and financial priorities. Whether you are spending less by necessity or because you are living more simply at home, this could be a good time...

Charity changes in a COVID-19 world

Apr 20 2020Many charities’ operations are affected by COVID-19. This might mean that some or all of them might need to be modified or even temporarily

halted. The Australian Charities and Not-for-profits Commission has stressed the importance of charities keeping stakeholders...

Compliance in a COVID-19 world

Apr 20 2020In recognition of unique challenges brought about by COVID-19, the ACNC has ruled out investigating certain breaches of governance and external-conduct standards from 25 March until 25 September. This approach is explained below. The commission believes that this...

ACNC urges PBIs to check their details

Apr 20 2020The ACNC is urging charities with deductible-gift-recipient endorsement to check their registration details. In July, the commission will begin reviewing DGR reforms announced by the federal government in 2017. The DGR review is designed to strengthen governance...

Market Snapshot: March 2020

Apr 15 2020In summary March was the most turbulent month for global financial markets since the onset of the GFC. Evidence of Covid-19 spreading into Europe triggered a sharp fall in equities and other risk assets, combined with a liquidity squeeze as demand for US$ cash...

COVID-19: Superannuation measures

Apr 15 2020Over the past few weeks, the Government has announced numerous measures to support the economy during the COVID-19 crisis. A number of those measures specifically relate to the superannuation industry. Temporarily reduce superannuation minimum drawdown rates...

Government Stimulus Package

Mar 17 2020Over the past week, there has been mounting concern with regards to the coronavirus (COVID-19) outbreak. With restrictions in place for travel and gatherings across Australia, and schools and workplaces braced for closures, it is increasingly important to be aware of...

Tax Alert: March 2020

Mar 17 2020The ATO is providing concessions to businesses affected by Coronavirus (COVID-19), but at the same time is getting tough on employee car parking benefits and investigating lifestyle assets owned by wealthy taxpayers. Here’s a roundup of some of the latest developments...

Hold On Bumpy Markets Ahead

Mar 12 2020After a period of optimism, global investment markets have hit the panic button on fears about the possible economic impact of the coronavirus (COVID-19). At times like these, it’s good to get some perspective. Australian shares rose 24 per cent last year, touching...

ATO to take a harder line on SMSF breaches

Mar 12 2020At the recent Self-Managed Superannuation Fund Association (SMSFA) National Conference, Dana Fleming from the Australian Taxation Office (ATO) outlined the regulatory approach for SMSFs going forward. Since 2014, the ATO has had enhanced powers for dealing with SMSF...

Market Snapshot: February 2020

Mar 12 2020In summary The first three weeks of February saw further good performance by global equity markets. The news from China about Covid-19 seemed to be getting better and the latest economic data was still quite positive. However, all this changed very quickly from 21...

Market Snapshot: January 2020

Feb 11 2020In summary January was a dramatic month for the world economy and financial markets, starting with hostilities between the US and Iran and ending with fears about the new coronavirus (2019-nCoV) from China. Here in Australia, we had the extra difficulties from the...

The Ins and Outs of SMSF Property Investing

Feb 11 2020With a property market recovery underway, most notably in Sydney and Melbourne, Australian investors are once again pursuing their love

affair with property investing. For many investors, a popular way to invest directly in residential or commercial property is...

The Hunt for Dividend Income in 2020

Feb 11 2020With interest rates at historic lows and likely to stay that way for some time, retirees and other investors who depend on income from their investments are on the lookout for a decent yield. Income from all the usual sources, such as term deposits and other fixed...

Are your insurance needs covered?

Feb 11 2020The start of a new year is always a good time to check whether your insurance policies are still serving your needs. But this year there is even more reason to review your cover. If your super balance is less than $6000 or you are under 25 and are a new fund member,...

Tradies: How does your insurance measure up?

Feb 6 2020As a tradie, you are largely dependent on your physical ability to earn a living. So, what would happen if you fell ill or had an accident? Would you be able to continue your current lifestyle? Most tradies work in a far more dangerous environment than any...

Fuel Tax Credit Rates Increase

Feb 6 2020Do you claim fuel tax credits for fuel you use in your heavy vehicle, farm equipment or other machinery for your business? The Australian Taxation Office recently announced an increase to fuel tax credit rates on 3 February in line with fuel excise indexation. Fuel...

Changes to accessing the ATO Business Portal

Feb 6 2020The way you access the ATO Business Portal is changing. From the end of March this year, you will no longer be able to use AUSkey as it is being retired by the ATO. If you are currently accessing the Business Portal using your myGov details (via Manage ABN...

Making donations from your Self-Managed Superannuation Fund

Jan 29 2020As you might expect, the current bushfire crisis has many Australians reaching for their wallets or purses to help emergency service organisations and those in need. For people with self-managed superannuation funds (SMSFs), there may be the temptation to use money...

2020 Vision for Financial Fitness

Jan 29 2020What better year to have your financial health in tiptop shape than the one requiring 20/20 vision! The start of any year is always a good time to assess your financial situation and make sure you are on track to achieving your dreams, but the start of a decade is...

Market Snapshot: December 2019

Jan 29 2020In summary December closed out 2019 on a positive note with equities, bonds and commodities all rallying as key economic data steadied and the US and China agreed to sign the Phase One trade deal. Central banks, including our Reserve Bank, flagged their intention to...

Tax Concession: Helping Small Businesses

Jan 16 2020Running a business keeps you pretty busy, so it’s easy to overlook the help that’s available. Many small businesses don’t realise the government offers a range of valuable concessions that can make a real difference to their annual tax bill. Depending on your annual...

Tackle your New Year Resolutions like a Pro

Jan 16 2020Ever look back on past New Year’s resolutions and notice they failed, not with a bang, but with a whimper? There was no dramatic quitting of that new class and no midnight burger binge. Instead, time just gets away from us. Other priorities come into our life. We just...

2019: Year in Review

Jan 16 2020It was a year of extremes, with shares hitting record highs and interest rates at historic lows. Yet all in all, 2019 delivered far better returns than Australian investors dared hope for at the start of the year. The total return from Australian shares (prices and...

Market Snapshot: November 2019

Dec 16 2019In summary November was a good month for equity markets as the broad risk-on theme continued. Both the local and US equity markets reached new highs. In contrast, the performance of bond markets was mixed, especially for the global bond markets, where expectations of...

The Changing Nature of Debt

Dec 16 2019Australians delight in their nation punching above its weight. But there’s little to celebrate in being the world’s silver medallists – we’re a nose behind the Swiss – when it comes to household debt. With the present-buying, holiday-taking season nigh, millions of...

Our Retirement System: Great, but room for improvement

Dec 16 2019You could be forgiven for thinking Australia’s superannuation system is a mess. Depending who you talk to, fees are too high, super funds lack transparency and Governments of all political persuasions should stop tinkering. Yet according to the latest global...

Limiting Deductions for Vacant Land

Dec 9 2019As part of the 2018-19 Federal Budget, the Government announced that it would limit deductions for expenses associated with holding vacant

land for the intended purpose of earning assessable income. This change is now law and applies to expenses incurred on vacant...

Unwrapping the joys and pitfalls of giving

Dec 6 2019Christmas is a time of giving, when thoughts turn to family and to helping those less fortunate. To gift in a meaningful way that maximises the benefits, it’s important to consider tax. While Australia doesn’t have a gift tax, there are tax considerations nonetheless...

Tax Alert: December 2019

Dec 5 2019If the introduction of Single Touch Payroll (STP) wasn’t a big enough challenge, small businesses can now look forward to the arrival of e-invoicing and changes to the Superannuation Guarantee (SG) rules. Here’s a roundup of some of the latest tax developments. ...

Sharing Yellow Buckets of Joy

Dec 5 2019The fifth instalment of the Yellow Bucket Appeal has officially kicked off for the 2019 festive season and we could not be more excited! Signing on to support this year’s cause as the major sponsor for the fourth consecutive year, our team of accountants, advisors,...

Stretching your travel budget further

Nov 25 2019Many Australians will soon be jetting or sailing away on their annual overseas getaway. Unfortunately, the value of the Australian dollar has been falling against the US dollar, British pound, euro, yen and even the Indonesian rupiah. Here are some suggestions on how to maximise […]

Keeping on the right side of SMSF rules

Nov 22 2019The lure of greater control over your retirement savings with a self-managed super fund may be enticing but the freedom to chart your own destiny also comes with the responsibility to comply with the rules. An SMSF is a private super fund regulated by the Australian […]

Superannuation Guarantee Amnesty

Nov 22 2019In September, the government re-introduced legislation that provides for an amnesty for employers who have under paid super for their employees. The amnesty will apply to underpayments of super that have occurred up to the original announcement date of 24 May 2018,...

Market Snapshot: October 2019

Nov 20 2019In summary After starting October on a cautious note, markets became a little more optimistic about global economic conditions as the month

progressed. News that the US and China would sign the so-called “Phase 1” agreement in the trade dispute contributed to the...

Tax and the festive season

Nov 6 2019As the festive season approaches it’s time to start thinking about celebrations and spending time with friends and family. For most business owners, it also means it’s time to start thinking about saying thanks to your employees for another year of hard work. But...

Get some wins on the board with effective business reporting

Nov 6 2019Too often businesses fall short of their goals because they don’t understand how to acquire and interpret data. Some cling to outdated reports that don’t reflect the contemporary market. Some get bogged down in so much information that it becomes meaningless. And...

Five signs of a well-run small business

Oct 16 2019Every small business owner wants their business to thrive, but it can be tough to keep the money coming in the door while staying on top of all the necessary paperwork. One way to ensure success is to understand the behaviours that separate a well-managed business...

Caring for family with a Will

Oct 16 2019Few of us like to think about death, let alone plan for it. But far from being morbid, getting your affairs in order and drawing up a Will is one of the kindest and most caring things you can do for your loved ones. Not only does a Will make your wishes clear but it...

Finding safe harbour when business is rough

Oct 16 2019Australia’s economy is growing at a slower pace than many would like, with small businesses in some sectors doing it tough. Recognising the warning signs of potential insolvency is key to trading through difficult times. An insolvent company is one that is unable to...

New ACNC governance toolkit

Oct 15 2019The ACNC has launched its ‘Governance Toolkit’, a collection of resources to help charities manage financial abuse, cybersecurity, working with partners and safeguarding vulnerable people. Each topic within the toolkit contains a comprehensive guide, useful templates,...

Help with AGMs

Oct 15 2019The ACNC has developed a handy self-evaluation tool that charities may use to assess whether they are meeting governance obligations. With the AGM season in full swing, self-evaluation gives you a chance to see if your charity is meeting ACNC standards. Download the...

Market Snapshot: September 2019

Oct 14 2019In summary September’s market action was in clear contrast to the previous month. August’s concerns about global growth, trade wars and geo-politics gave way to a somewhat more optimistic mood in which the relative performance of key asset classes was reversed. In...

Building wealth in diversity

Oct 14 2019What a difference a year makes. In recent months, Australian shares hit a record high, the Aussie dollar dipped to levels not seen since the GFC and interest rates were cut to historic lows. Towards the end of 2018, shares were in the doldrums and while experts agreed...

The full nest: living with adult children

Oct 14 2019The number of young adults living in the family home well into adulthood is growing. ABS data indicates, amongst adults under 35, nearly one third are still at home, and the trend is on the rise. If managed well, multigenerational living can be beneficial to both your...

Review of the retirement income system

Oct 14 2019The Government recently announced an independent review of the retirement income system. The review, which was recommended by the Productivity Commission in their report Superannuation: Assessing Efficiency and Competitiveness will look at the so called three pillars...

Market Snapshot: August 2019

Sep 17 2019In summary August was a turbulent month for global financial markets. The concerns that emerged at the end of July about the trade dispute

between the US and China, and about how much the Fed might cut rates, all spilled over into August. Fears of global recession...

How super is your life insurance?

Sep 17 2019For most people, life insurance provides a safety net against unexpected events. This is particularly the case if you have a mortgage, debts or family who are dependent on you earning an income. In many cases, life insurance has been automatically offered through...

Pensions to rise as deeming rates fall

Sep 17 2019It’s been a long time coming, but up to 630,000 retirees could soon enjoy a small but welcome increase in their Age Pension payments following a cut in deeming rates used for the pension income test. Under the Age Pension income test, you are ‘deemed’ to earn a...

Tax Alert: September 2019

Sep 12 2019The landscape of Australia’s personal income tax system has changed significantly following the passage of the Government’s tax legislation through Parliament. Here’s a roundup of some of the other recent developments in the world of tax. Tax reform legislation..

Managing your side gig

Sep 12 2019Whether it’s to pursue a passion or to make a little extra money, more Australians than ever now have a side gig. But while freelancing, moonlighting and pursuing passion projects can be a great way to add value to your life, they can sometimes complicate how you go...

Positives and negatives of gearing

Sep 12 2019Negatively gearing an investment property is viewed by many Australians as a tax effective way to get ahead. According to Treasury, more than 1.9 million people earned rental income in 2012-13 and of those about 1.3 million reported a net rental loss. So it was no...

PB Agrifood

Aug 26 2019PB Agrifood Director, Peter Brodie grew up on a farm in Dalby. After deciding that a career in agriculture was for him, he enrolled in Gatton college to complete a formal education in the field. After graduation and testing out a Government role with the Department...

Market Snapshot: July 2019

Aug 19 2019July was all about interest rates, with the Reserve Bank and the Federal Reserve both cutting. Here in Australia, the cash rate and bond yields are at new record lows. The RBA said it will pause to assess the impact of its actions, but did not rule out more cuts, and...

Where is the best place to stash your cash?

Aug 19 2019If like many Australians you’re looking for ways to put some cash away for a rainy day, a holiday or to earn extra income, the job has just become a bit harder. It’s also become more urgent if you are expecting a handy tax return. In early July, the Reserve Bank cut...

Re-balancing your super